“Davidson” submits:

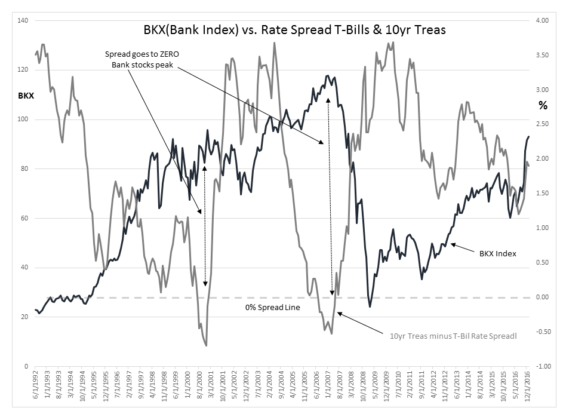

Keefe, Bruyette & Woods Bank Index (BKX) has a correlation to the T-Bill/10yr Treasury rate spread when the spread shifts to 0.0%. This is because lending by financial institutions is dependent not on rates per se, but on the rate spread of the cost of funds vs. return of loans (bank profits) for which the T-Bill/10yr Treasury rate spread is a proxy.

When the T-Bill/10yr Treasury rate spread shifts to 0.0%, lending slows substantially. Those sectors of the economy which are over-levered and reliant on additional lending to consumers to keep their own borrowings current will suddenly find themselves having great difficulty paying required interest payments. The pull-back in lending sets into motion the conditions which lead to defaults rising which perversely cause financial institutions to reduce lending exposures more. This is how all major economic corrections occur. Lending which had become too optimistic on economic returns does an about-face and becomes mostly focused on avoiding losses.

Recent financial sector performance is tied to the reversal in the rate spread trend. The spread has been on a roller-coaster pattern since 2009 when it had peaked at 3.70% in April 2009. Capital flows into the US seeking better returns gradually lowered the 10yr Treasury rate causing a narrowing of the spread till July 2012. The combination of a narrowing of the rate spread and Fed regulations and Treasury fines kept financial company issues under pressure till investors shifted capital out of 10yr Treasuries seeking returns elsewhere. Then early 2014 the rate spread peaked at ~2.8% when Russia invaded the Crimea and Ukraine which sent capital back to the US$. The 10yr Treasury rates fell narrowing the rate spread to 1.09% (monthly avg 1.20%) in July 2016. Slowly from this point the rate spread began to widen and after the election the promises of the incoming Administration sent it soaring to more than 2% in less than 1mo. Financial stocks have responded accordingly.

If the T-Bill/10yr Treasury rate spread continues to widen, then financial issues should will have strong support for a rise. Investors need to be aware that geopolitical issues weigh heavily on the level of US$ and 10yr Treasury rates in a global economy. Capital shifts due to perceptions or risk/reward can change fairly quickly depending on unpredictable geopolitical events. Even though conditions appear quite positive for a US$ reverting to trend (~35% lower) which can result in a further widening of the rate spread (more lending available) and higher equity prices, one always needs to be aware that conditions can become more negative.

For now, markets are set to rise long-term. Financial stocks and markets do not peak till the T-Bill/10yr Treasury rate spread shifts to 0.0%