“Davidson” submits:

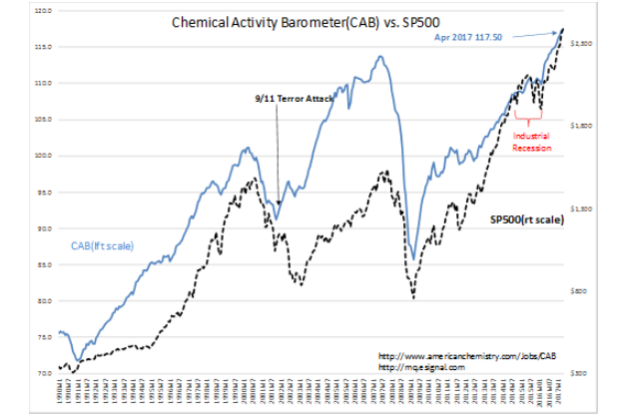

The Chemical Activity Barometer(CAB) was reported at an all time high once again. The SP500 on the French primary outcome has surged higher as have Intl LgCap issues and the US$ is lower. The sands of economics are shifting and it all suggests we are likely to see much higher stock markets the next few years.

First, the CAB, a broad economic indicator which can forecast the direction of economic activity up to 18mos ahead, has been rising sharply since Apr-May 2016. US companies impacted by the period of strong US$, show that they have adjusted to the impact a strong US$ had on commodity prices and export headwinds. They have exited an industrial recession. A rising CAP is the result. For investors, economic expansion should result in higher levels of employment, general retail sales and specifically continued vehicle and new home sales.

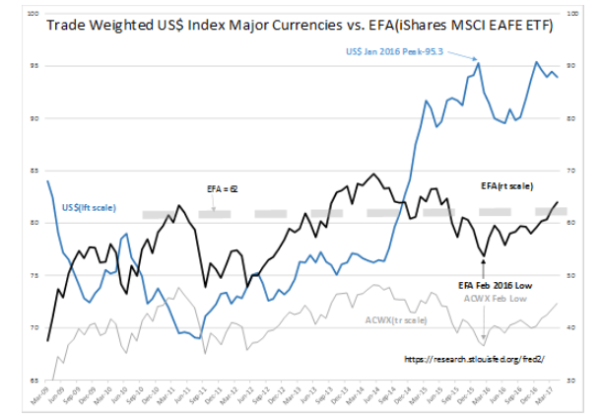

Also a positive for investors is the long-awaited beginning of a fall in the US$ back to its long-term trend. Eventually, we can expect to see the US$ 35% lower once it reaches this trend. It may take 5yrs+ to do this. A falling US$ makes US exports more competitive globally and spurs economic activity. It spurs global trade.

For investors, a falling US$ makes Intl Equities more attractive and results in rising Intl Equity prices. A heathy rise in the EFA, (represents Intl Lg Cap ex-US equities) has already begun since Feb 2016. The ACWX(All World Capital ex-US equity index) is also shown on the chart as having a similar trend. For the EFA, rising above 62(current level is 64) is likely to be significant to trend followers.

One of the major changes becoming evident today, has been the election of political leaders not from the body of professional political leaders which have produced leaders for more than 30yrs. Voters want a change. They want a fresh view in leadership. The UK vote for BREXIT was based on this desire for change. Already, notable changes have occurred in the regulatory structures implemented in recent years. It is too soon to judge the outcome of sweeping change, but investors have anticipated faster growing economies and priced markets higher. That these events are not ‘smoke and mirrors’ can be seen in the CAB.

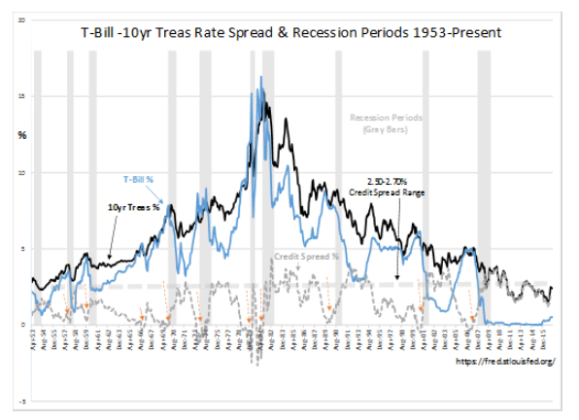

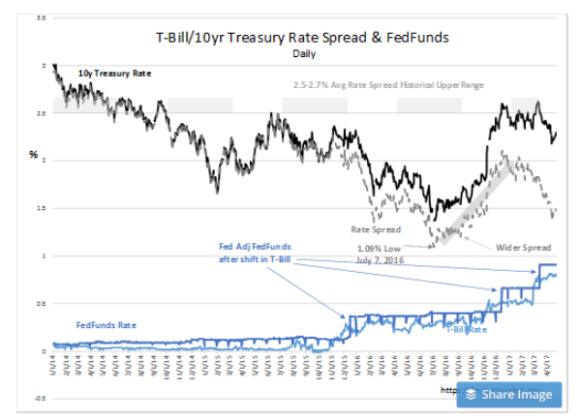

Other evidence comes from the T-Bill/10yr Treasury rate spread. Once we exit a recession, history shows that economic activity continues to expand till the rate spread narrows to 0.20% or less. Narrow rate spreads choke off bank lending and with it economic momentum. This is a primary indicator for major market tops and the onset of recessions as shown in the history from 1953-Present.

The current rate spread is ~1.50% in the daily chart and well away from indicating a market top. There are ebbs and flows in market psychology. The recent Presidential outcome saw a widening(a flow) of this spread as market psychology shifted towards optimism and drove 10yr rates higher. This was due to investors shifting capital into equities. Then we saw a narrowing(an ebb) as investors exhibited 2nd thoughts or believed they had jumped too far ahead without solid evidence. Markets are like this.

After a little more than 1mo of narrowing spreads, we are seeing spreads the last 2dys begin to widen on the French election outcomes. Market psychology impacts prices and interest rates. The current pattern is one which reflects continued optimism. The signs of excess optimism come from T-Bill rates rising due to investors selling out safe investments to go all-in to equities. This shuts down lending by narrowing the T-Bill/10yr Treasury rate spread 0.20% right at the top of optimism and results in a market/economic top.

The current economic environment is one of expansion held back by a much higher level of regulation and government influence than had been the level in past recoveries. The impetus to remove impeding regulations are likely to spur economic activity. The CAB and T-Bill/10yr Treasury rate spread support this outlook. It is likely that economic activity could continue to expand for several more years. Equity investors experiencing better economic news than expected have always priced markets higher.

My recommendation continues to favor LgCap Domestic and Intl Equities with some exposure to Natural Resource issues.