“Davidson” submits:

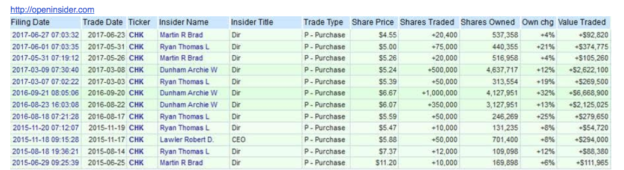

One of the tools I use is to track insider activity. The most important aspect of investing on which few focus is the quality of the management team. I spend most of my time on research developing an understanding of corporate management’s skills and outlook. If one spends the time detailing management’s background, their business relationships and couples this to their business performance and cash commitments to future common stock performance, one can build an investment case for a business at a particular price range.

The commentary of insiders must align with their business decisions, i.e. they must ‘walk the talk’, and how they execute must result in improving financials. Important in the process is listening to quarterly conference calls and investor presentations . It is listening to not only what they say about themselves but also how they articulate it. In my experience, one gets deeper insight when a CEO is speaking from their solar plexus as opposed to speaking from the throat. Speakers who enunciate from the ‘gut’ generally speak from a position of commitment to what they believe to be true. We can hear the difference when this occurs. Those who speak from the throat sound as if they have weak commitment to their beliefs and are thought of as glib. It is our empathy, the human truth meter, which is separates fact from fiction. Seeing appropriate insider activity, provides support for management’s commentary and what can be seen in the financials. Seeing multiple insiders in an industry act similarly helps in understanding what management may be seeing.

I see insider activity currently in oil/gas sector which supports a positive outlook and in CHK in particular. With the market psychology being skewed well towards pessimism, any positive surprise will cause share prices to rise, This morning on CNBC the talk is for oil well below $40 BBL on over-supply/under-demand. None of this talk is based on fundamentals.

The differences in ‘how the market thinks’ vs. the factual evidence is where investment opportunities lie. One cannot rely on analysts to provide the detail necessary because their reports are always a condensation of a broad swath of data and misses the details one gets from the individual stories like the one below which captures current consensus opinion. The statement that investors are judging markets as over-inventoried based on being ‘above the five year average’ shows that consensus has missed the ramps in refinery input and refined product exports which have occurred as the global recovery progressed. At some point the market psychology will flip to reflect the recognition of growing consumption and the need for increases in the 30dy of supply required to ensure even flow of product to markets.

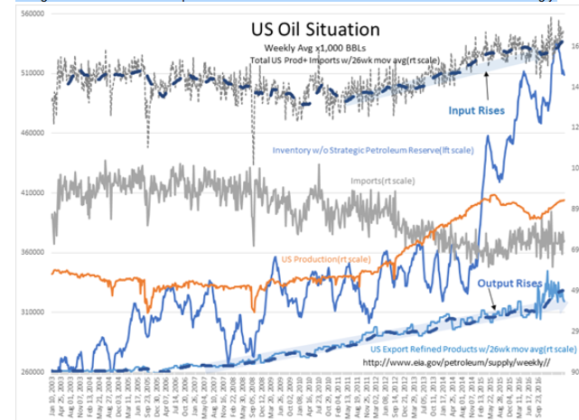

At the moment US inventories have fallen over 26mil BBL from the peak in March which is typical for this point in the seasonal pattern. An additional 26mil BBL drop by Sept-Oct this year would fit the seasonal pattern of 10% inventory declines Spring-to-Fall. One can see in the US Oil Situation chart the history of US Inventories relative to US Exports of Refined Products. Total US Production + Imports and Inventories have risen to accommodate global demand. When US Production fell in 2015-2016, Imports were raised to supply the necessary Inventory levels to meet exports of refined products. There has also been increased demand in the US with record vehicle miles traveled(not shown).

Market psychology remains fixated on the single parameter of inventory as if it this was a static measure of the entire energy industry. The consensus ignores the more complex and dynamic supply/demand context and the expanding role of the US as a global refined product supplier.

I continue to recommend investors add to energy related issues. Investor pessimism about oil Supply/Demand is misplaced. At some point in the economic cycle, investors have always become more positive on oil and energy producers. When this occurs has always been unpredictable. As investors, what we can do is to recognize when consensus opinion does not match the actual evidence and invest accordingly.

Current market psychology

The story continues to be promoted of OPEC over-production while the EIA global data show balance has been present since Feb 2016. The production rise coincides with a rise in US inventories as US brought Days Supply vs Refinery Inputs from mid-20s to 30. The US has since stabilized either side of 30 Days Supply vs Refinery Inputs. Adding to inventories is part of the Consumption figure.

The facts remain that the US has had a substantial rise in refining and export of higher-valued refined products. The US raised inventories to ensure steady supply. Global Prod/Cons is now in balance but the story of excess production persists.

Going forward US inventories should rise apace of refined product exports now that a higher level of inventories has been established.

Rarely does the consensus get the actual story correct and a mythological view of how the world works becomes part of perception.

Net/Net:

Companies must adjust to change with change a constant occurrence. Markets always miss corporate management’s ability to shift and remain focused on past and static perceptions such as the obsession with inventories when higher inventories reflect the need to supply product to meet higher global demand. Market prices are set by market psychology using stocks and futures markets. Psychology can be wrongly focused for several years before economics forces it back to reality. The reason for this is most investors do not focus on economics but on prices for their investment perception . Prices shift very quickly while economics shift at a snails-pace building up till investors suddenly notice they are wrong and suddenly scramble to adjust to the newly discovered reality. Many believe we have “Black Swans” arising out of nowhere, but the truth is they were looking only at prices, not economics.