“Davidson” submits:

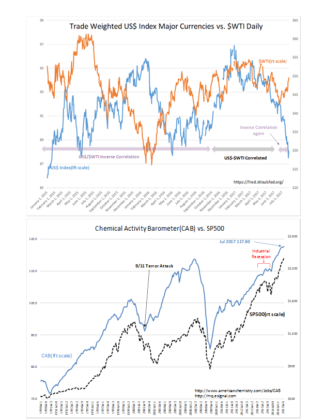

Markets continue to reinforce that the long-held inverse relationship between the US$ and $WTI(as well as many other commodities) remains intact.

There was a short period from roughly Aug 2016-end of June 2017 during which the relationship appeared on-again/off-again. The past 4wks supports the reemergence of the inverse correlation which has been a hallmark of $WTI since 2003.

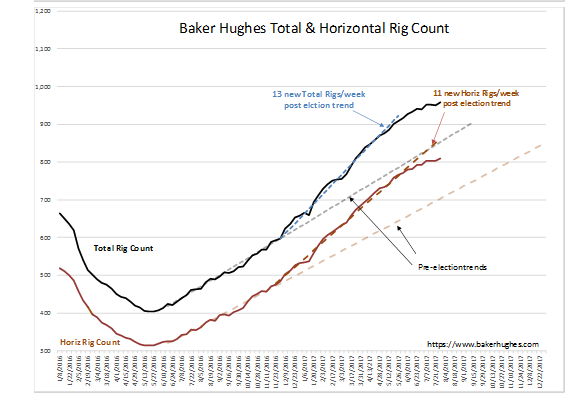

Updated US$ vs. $WTI as of this morning. Looks like the inverse correlation is in full swing. This predicts higher $WTI and improved environment for US Industrials. The falling US$ is beneficial for high-value US exports, but the past 2 Quarters of earnings reports indicate that US Industrials adjusted to the strong US$ at least 12mos ago as can be seen by the rise in the Chemical Activity Index(CAB). The CAB just reported a new high. Analysts and the media have focused on US Oil Production recovery(back to record levels) and the rising Baker Hughes Rig Count(appears to be topping here short term) with the consensus forecast of flat $WTI for the next decade with some even calling for a price collapse to the $20BBL level. I do not see this as likely with the economic demand remaining strong.

Markets continue to reinforce that the long-held inverse relationship between the US$ and $WTI(as well as many other commodities) remains intact. There was a short period from roughly Aug 2016-end of June 2017 during which the relationship appeared on-again/off-again. The past 4wks supports the reemergence of the inverse correlation which has been a hallmark of $WTI since 2003.

Updated US$ vs. $WTI as of this morning. Looks like the inverse correlation is in full swing. This predicts higher $WTI and improved environment for US Industrials. The falling US$ is beneficial for high-value US exports, but the past 2 Quarters of earnings reports indicate that US Industrials adjusted to the strong US$ at least 12mos ago as can be seen by the rise in the Chemical Activity Index(CAB). The CAB just reported a new high. Analysts and the media have focused on US Oil Production recovery(back to record levels) and the rising Baker Hughes Rig Count(appears to be topping here short term) with the consensus forecast of flat $WTI for the next decade with some even calling for a price collapse to the $20BBL level. I do not see this as likely with the economic demand remaining strong.