“Davidson” submits:

There are many calls today for a correction, but economic activity continues to move forward and markets follow. Lately it seems many well-known and media-popular forecasters have called for another market/economic correction.

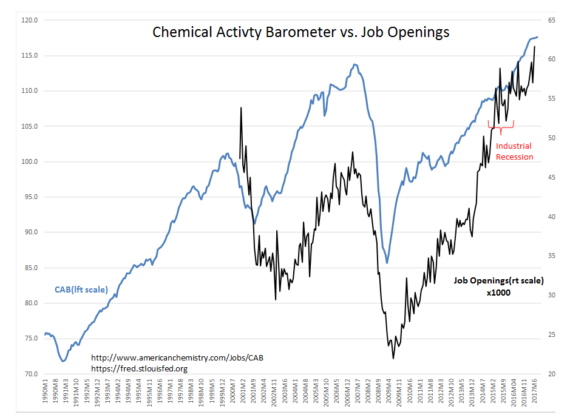

Economic activity meanwhile continues to expand as reflected in the Chemical Activity Barometer’s(CAB) record high and the Bureau of Labor’s Job Openings report.

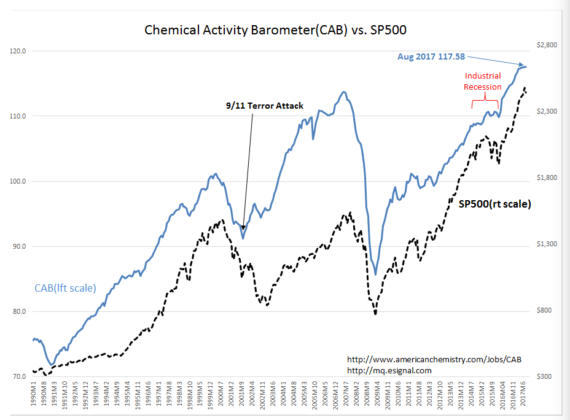

The SP500 follows economic patterns as positive economic news continues to drag new investors into equities. Markets following long-term economic trends has been and continues to be our history.

The market participants can be sorted into 2 basic investor types, i.e. Value Investors and Momentum Investors. Value Investors dive into economic and business fundamentals to justify buying/selling equities at specific levels. They understand that markets are not efficient pricing mechanisms of business returns. Their perceptions are long-term and they understand market cycles. They are the few telling investors to buy when most are selling. Their holding periods are viewed as long, long-term when compared to Momentum Investors. Their average holding periods are often more than 4yrs. Some Value Investors become nervous once Momentum Investors dominate market pricing.

Momentum Investors believe that markets are efficient and, in fact, they believe that markets are the drivers of economic activity. They are price trend followers. They believe that prices reveal future economic and business trends. As prices deviate from trends, Momentum Investors trade portfolios accordingly. Their holding periods are often less than 12mos and frequently less than 1mo. Momentum Investors develop and implement computer algorithms to implement trading strategies. Because Momentum Investors are responding constantly to changes in price trends, they change their opinions frequently and provide a stream of interesting commentary for the media. Media content mostly comes from Momentum Investors.

Investors need to understand both Value and Momentum Investor thinking if one expects to invest through the entire market/economic cycle. Value Investing makes sense during recession lows when long-term business returns are identifiable, but not so once Momentum Investor thinking dominates pricing later in the cycle. Later in the cycle as we see today, there are many recommendations made by Momentum Investors based on price trends which appear as ‘nonsense’ to Value Investors. TESLA, NFLX, FB and others where this demarcation is strongest. It is the current level of speculative excess in certain issues which have some calling for a significant market correction. A market/economic correction is not at hand!!

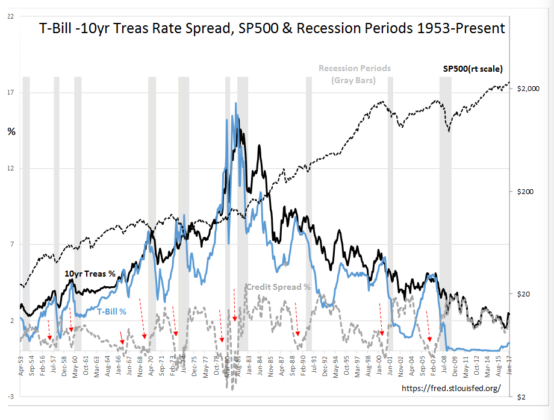

How one can know this comes from the history of the T-Bill/10yr Treasury rate spread history compared to the SP500 and our recession history from 1953. Market corrections (see the RED DASHED ARROWS)occur every time the T-Bill/10yr Treasury rate spread falls below 0.20% or 20bps. The one instance when there was a market correction but not a recession was in Jan 1966. This rate spread is a proxy for bank/institutional lending. Lending institutions take in short-term funds, guarantee their safety and lend a proportion to borrowers capturing the T-Bill/10yr Treasury rate spread + additional spreads to generate profits. Mortgage lending adds on average an additional 1.60% or 160bps to the spread for standard mortgages. Today, the T-Bill/10yr Treasury rate spread of 1.25% + 2.00% equates to 3.25% return or 325bps for 4.20% mortgages backed by residential property.

The T-Bill/10yr Treasury rate spread is dynamic. It changes daily. During recessions, investors panic and buy T-Bills to preserve capital driving the rates to low levels. This widens the spread which makes lending more profitable and sets the stage for economic recovery. Spreads during recessions are typically more than 2.00%. Once lending begins and investors begin to develop greater confidence in markets the spread begins to narrow as capital comes out of T-Bills seeking higher rates of return. Rates across the yield curve gradually rise during economic expansion. The end of every economic expansion can be identified as investor confidence builds to chase returns by selling ever more T-Bills. This behavior drives T-Bill rates to the point that the T-Bill/10yr Treasury rate spread contracts to 0.20%. This rapidly slows lending. Speculative investments and excess leverage as investors chased returns rapidly becomes obvious. Lenders shift to more conservative underwriting. The economy corrects and markets follow.

The historical record of the T-Bill/10yr Treasury rate spread is the best indicator with which one can identify market cycle tops. Today with the spread at 1.20%, any calls for a ‘market top’ are misplaced. The CAB, Job Openings and other economic indicators continue to signal the likelihood of the current economic expansion continuing for another 3yrs-5yrs. Our current cycle experienced an industrial recession when the US$ strengthened in response to world turmoil. It appears the US$ is normalizing to its long-term trend which should propel additional global economic expansion.

Contrary to media reports, there is no “market top at hand”.