Davidson and I have disagreed on real estate for some time now. My take is that we are woefully short on supply and builders just aren’t building homes at the pace they used to and commercial building has been just as sparse. Because of that there will be constant upward price pressure on real estate.

Add to this a dramatic loosening of Dodd-Frank legislation that I feel will only increase demand as lending normalizes. So, while I agree housing at some point will see another period of price declines or stagnation, I don’t think this happens outside of a US recession.

We will see…….

“Davidson” submits:

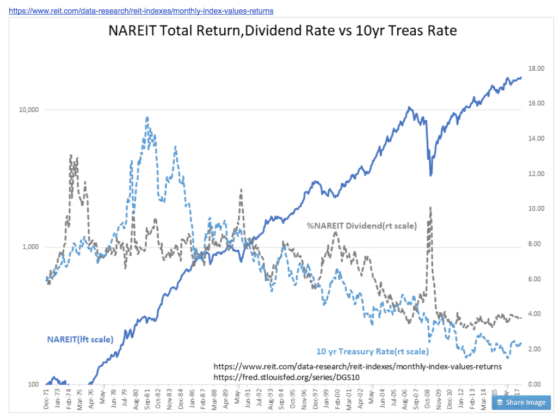

US Real Estate character has changed over time with influx of foreign capital. REIT dividends have been competitive with 10yr Treasury rates. As inflation fell through 1980s to 1990s rates followed, real estate was priced higher and dividend rates followed that of 10yr Treas. The 10yr Treas at 2.4% is half where this rate should be(~5.0%) vs. ‘Natural Rate’ at 4.6%. This is due to the influx of foreign capital the past 10yrs.

We should normalize over time if Trump pushes back sufficiently against sociopathic elements of Iran, No Korea, Russia, China and etc. Global capital will then rebalance and rates will rise, real estate will fall in popularity. This cycle will take time but it will occur.