“Davidson” submits:

Boeing is 9%+ of the Dow Index: http://indexarb.com/indexComponentWtsDJ.html

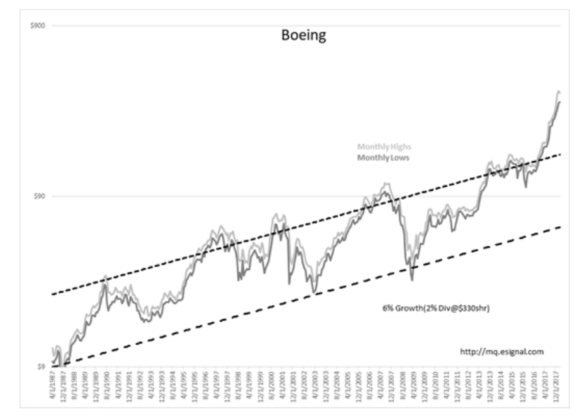

First question which should be asked is, “Should BA be price this highly?” Has there been some acceleration of returns different from its history which justifies this? Certainly has been plenty of media attention.

Attached is the data from Morningstar and its chart. Also attached is the data of the price history.

A couple of things are occurring at BA. Normal revenue growth of 5.65% has stalled. As it exits the high US$ period 2014-2016, there has been a pop in OpMargins and also in Net Income as BA has not slowed its ‘lean mfg’ processes and it pulls out higher margins on the same Revenue $Dollar. Also, it popped EPS through a 2yrs share buyback dropping shares from 695mil to 610mil driving EPS artificially higher. Book Value/Shr has plummeted as a result.

Does BA justify being priced more than 100% above its historical Monthly Highs trend?