“Davidson” submits:

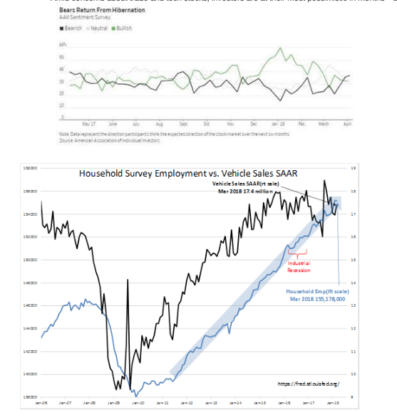

The majority of investors take their investment guidance from price trends and the recent shift sideways with volatility in the FANG stocks has created higher pessimism. Today’s employment report, -37,000 in the Household Survey Employment, remains solidly in an up trend. Light Weight Vehicle Sales for March of 17.4mil SAAR(Seasonally Adj Annual Rate) is typical at this point in an expanding economic cycle.

“One Reason for Optimism: Bearish Investors” https://www.wsj.com/articles/one-reason-for-optimism-bearish-investors-1523006335

Amid concerns about trade and tech stocks, investors are at their most pessimistic in months—an encouraging sign for some

The Investment Thesis:

While recent market volatility, especially with FANG issues, has caused many to become pessimistic, the underlying economic indicators remain solidly in up trends. Equity markets should price higher as additional economic reports support a positive outlook.

Markets are composites. FANG issue performance in this cycle is no different than previous cycles in which a few issues dominate the news and index performance. In the process, many issues with excellent long-term performances receive little media focus. It appears that the weakness in FANG issues has resulted in some recognition of some of these issues as they suddenly outperform.

Investors must always be selective