“Davidson” submits:

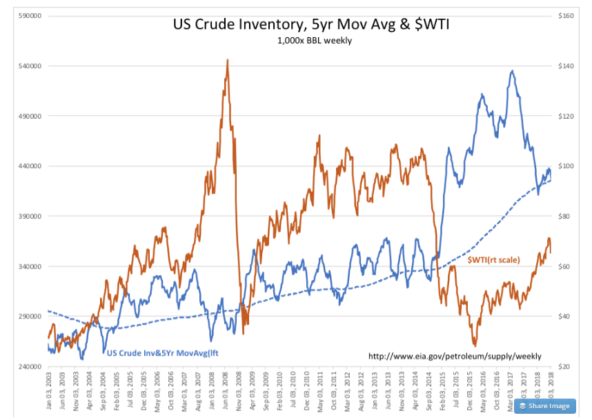

Hearing the 5yr avg inventory so many times, I ran the weekly reported US Crude Inventory, vs its 5yr Moving Avg and $WTI. The correlation when the Inv crosses above or below the 5yr Mov Avg is quite strong. This shows the market’s thinking. Investors act as if demand has been static the past 5yrs when global demand has been rising steadily.

Market psychology is what it is. No wonder $WTI has been higher recently and popped 4%+ today.