“Davidson” submits:

We are in interesting times! The economic data continues to surge while the consensus calls for correction. Usually, these notes report and comment on the current relevant data. Even though it is understood that previous reports have been revised and sometimes noted, the JOLTS(Job Openings and Labor Turnover Survey) is worth a special comment. It was reported today at 6,939,000 while previous months were revised higher by 160,000 or ~2.5%. JOLTS have a 1mo lag and today’s report represents data from July 2018, but reported 1mo later in September while other employment related reports are reported within a few days of data collection. Nonetheless, the JOLTS, along with Temporary Help report, provides a sound basis for estimating future full employment trends.

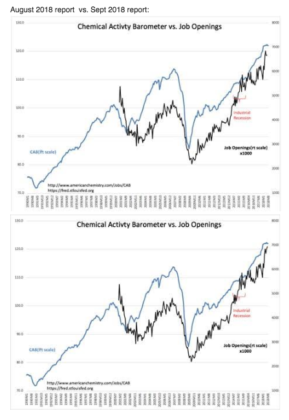

Economic data is collected and analyzed statistically which means data is always incomplete with reported levels estimated. As more complete data is collected, previous reports are revised. This leaves the most recent report of questionable value unless viewed in economic context, i.e. ‘The Trend’. The trend or changes in the economic data does provide insight to future economic activity especially when compared against other indicators. That the current JOLTS has reached a new high, that previous month’s data has been revised higher, that this trend is reflected in the Chemical Activity Barometer(CAB) trend and trends of several other indicators and especially with many CEOs anticipating additional hiring to meet existing demand, we are in a very positive investment climate.

What makes the current environment particularly positive for equity investors is the pessimistic consensus which abounds in nearly every nook and cranny. It is always the ‘Johnny-come-lately’ investors who push equity prices higher once positive headlines convince them they are about to miss out on market gains.

The Investment Thesis Sept 11, 2018:

The consensus is pessimistic-the economic data is incredibly positive. Equity prices are expected to rise!