“Davidson” submits:

Most investors are confused by sell-offs. Sharp declines are scary and result in further panic selling. This is especially so when most of the investors one hears in the media believe that markets forecast economic activity. In reality, it is economic fundamentals which drive market prices, but with few paying close attention the former is accepted and taught in our business schools. Truly, the greatest misperception of markets imbedded by continuous repetition for hundreds of years is the belief “markets lead”. That markets forecast economic trends or even determine them has been the foundation of much investment perception its earliest days. Detailed examination of 70yrs of modern financial history that markets follow economics. Market prices are established after economic trends become widely recognized. Markets follow, they do not lead! This is the basis of investment opportunity for fundamentally focused investors.

Computer driven algorithms, created by Momentum Investors, are not fundamental indicators. The designers of algorithms incorporate past price correlations such as falling oil prices, rising US$(US Dollar) and a narrowing of the 2yr/10yr Treasury yield spread to recessions with the goal of out-trading other investors. Algorithms are for short-term trading and are based on price trends. Fundamental analysis is ignored. Price trends are used by Momentum Investors and believed to carry all the necessary information required. Financially impacting headlines are a significant factor in setting short-term price direction. Periodically conditions ripen to the point that algorithms signal a trend inconsistent with fundamentals. Today’s market pessimism is one such period. This has in turn captured the media’s focus on comparing today with the 1930’s Great Depression which has exaggerated today’s period of market pessimism. It is periods such as today when the trader’s panic drives prices widely from economic fundamentals and becomes a buying opportunity for investors who recognize it. How does one identify when a short-term panic is a buying opportunity?

Telling when a trader’s panic is a buying opportunity for fundamental investors requires insight that comes from comparison of previous panics using reliable data sources. I use a combination of sentiment and fundamental valuation measures both ‘Top Down’ and ‘Bottom Up’. The greatest mistake investors become prey to is the media perception that markets are homogeneous. The media theme today is that the price trends of the F.A.N.G type stocks are all you need to know. Not so!!

Markets are a composite of thousands of companies. In every cycle, a few issues become trader’s favorites which become the media focus. The media has always identified these few as deserving of nearly daily, sometimes even hourly focus. The common phrase ‘…as goes XXXXXX, so goes the market…’ and the assumption is ‘…so goes the economy!’ occurs every market cycle. It is these heavily touted issues which enter and come to dominate the indices over a cycle. The volatility of these few issues, because of the combination of media attention and so much Momentum driven capital chasing their price trends, comes to dominate the volatility of the indices and in turn dominate the consensus perception of the economy. Momentum Investor domination of the F.A.N.G issues is why there is little connection with their fundamental valuations. Each cycle has its own version of ‘F.A.N.G issues’. Ignored are the thousands of other companies of every composite index which provide valuable detail as a basis of fundamental analysis. It is through the fundamental detail on which there is little media focus that one identifies when a Momentum Investor’s panic is a Value Investor’s buying opportunity.

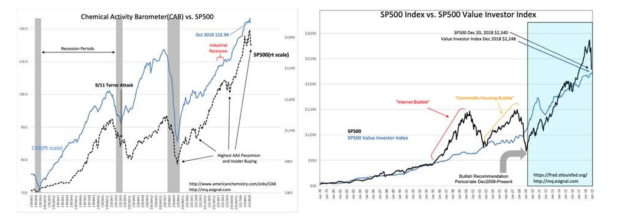

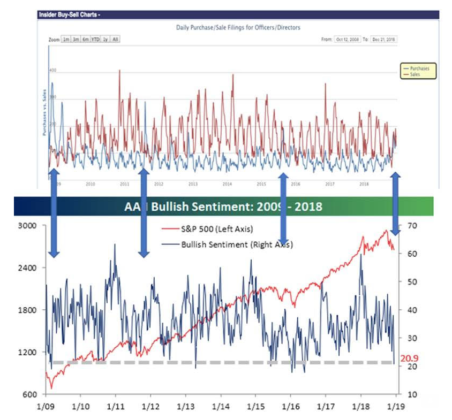

The body of fundamental/sentiment data is detailed and more voluminous than a single note can provide. A few key sources, fundamental and market sentiment measures are helpful. The Chemical Activity Barometer(CAB and the SP500 Value Investor Index are reliable fundamental indicators. The CAB is a measure of US general economic activity developed using chemical industry inputs. Chemistry is a vital aspect of every nook and cranny in the US economy which has reliably identified economic peaks and lows. The SP500 Investor Value Index(VII) is based on Knut Wicksell’s ‘Natural Rate’. The VII is unique to the long-term SP500 earnings and the US GDP growth and is a measure of SP500 valuation. CAB indicates that we continue solidly in an economic uptrend while the VII indicates the SP500 is under-priced relative to previous cycles. With the SP500 at a 3% premium to the VII, it remains well below peak premiums of 60%-100%. The VII is only used to identify ‘Top Down’ Value investor buying levels such as we see today. Today’s SP500 is a level of market pessimism which attracts Value Investor buying. The AAII is an investor sentiment measure. AAII Bullish Sentiment is today at the lowest levels since 2009 and coincides with previous periods of relatively high insider buying. Insider Buying is both a fundamental and a sentiment indicator. Corporate insiders are the most knowledgeable Value Investors. They are in the best position for identifying when their own shares are under-valued versus economic context. Historically, insider buying never occurs in ‘high-fliers’ in any market cycle and the same is true today.

Markets are composites of thousands of unique companies

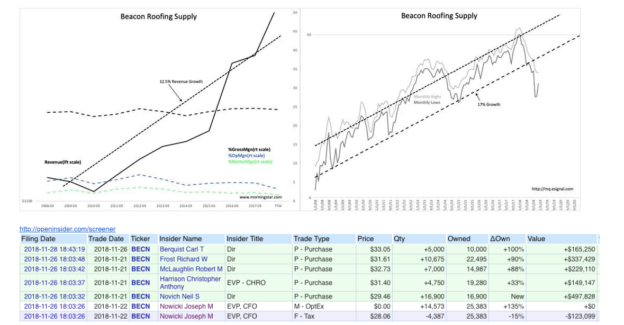

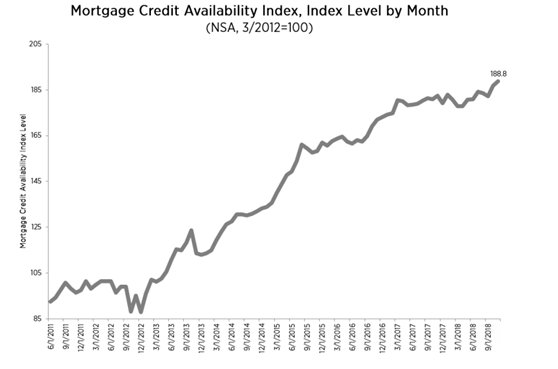

Markets are composites of thousands of unique companies. Beacon Roofing(BECN) is one example of many available in the current environment. By analyzing numerous well-managed issues which have suffered price declines, one comes to the realization that many well-managed businesses remain solid and shares are undervalued. One determines this through detailed analysis which assesses management’s performance history, how the market has priced the shares in the past, insider activity and finally analyze the broader economic context in which management operates. BECN’s data speaks for itself. The current rise in the Mortgage Credit Availability Index(MCAI) indicates improved mortgage credit should spur housing activity and be a strong positive for BECN. Note that the MCAI stalled 2yrs ago, but recently accelerated as FDIC Chair Jelena McWilliams as eased Dodd Frank regulations for smaller banks.

There are many well-managed companies with price declines today which have increased insider buying activity. Together, these companies form the composite for today’s period of Insider Buying exceeding Insider Selling. Insider Buying has always been a reliable indicator at market lows, very much like the VII.

http://openinsider.com/screener

Time to Buy! This is how do you know!!

Most investors feel spooked today with the media flood of negative information. During periods such as today it is difficult to sort fact from fiction. It is always helpful to be reminded that the goal of the media is to garner attention. After all, it is about gaining and holding viewership on which advertising revenue is dependent. Bad news is what creates viewership. It is how humans are wired. Stress those issues which raise investors fears and viewership rises along with ad revenue. When the consensus is spooked, emotions can overwhelm reason and a herd mentality kicks in, especially when one’s friends are spooked. This makes it very difficult to hold a contrarian perspective and locate specific opportunities. In such an environment the power of suggestion can take hold, be amplified through algorithms and further amplified by the media.

In such an environment, we need to be reminded that markets follow, they do not lead. If we can sort fact from emotionally driven thinking, then we remain on track for sound investment decisions. One accomplishes this by working through the detailed analysis as discussed. Through this process the buying opportunities in many BECN-like examples become apparent. In simple terms, it is a composite of buy signals produced by many separate issues with the right blend of ‘Top Down’ and ‘Bottom Up’ factors. None of the F.A.N.G issues qualify nor have they had the characteristics to qualify as good fundamental investments. (That F.A.N.G issues do not sport attractive management/fundamental metrics is one reason it permits them to be driven by Momentum investors who invest with headlines holding little substance.)

By performing fundamental analyses several hundreds of times throughout a market cycle, one comes to know that the current environment is a Time to Buy!