“Davidson” submits:

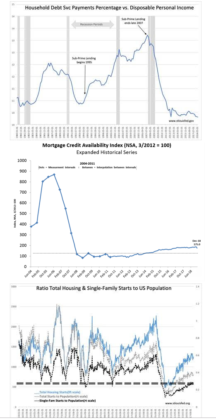

High Household Debt levels relative to Disposable Personal Income are the glass houses which collapse when stress hits financial system. Current levels of Household Debt Svc are the lowest since inception of this series in 1980. It is shocking to hear so many ‘experts’ at Davos and elsewhere forecasting that recession as imminent.

Once you recognize that many investors take their economic perceptions from price trends, then you come to understand that fundamentals such as Household Debt levels relative to Disposable Personal Income are not part of their thinking. With Household Debt levels relative to Disposable Personal Income at the lowest levels since 1980, nearly 40yrs, the threats of recession from an excessively levered financial system are quite low.

Recessions occur when lending momentum suddenly shifts much lower after several years of rising activity. Historically this has occurred when investor optimism expands and drives T-Bill rates higher. This narrows the rate spread between T-Bills/10yr Treasury rates which is a good proxy for lending momentum. Historically once this spread has fallen to 0.2% or lower, lending slows and defaults rise which results in a correction of recent financial excesses. Lender psychology shifts quickly sharpening the correction.

Government policy changes can lead to shifts in economic trends but generally politicians do not act to create recessions. The Sub-Prime lending explosion that began in 1995 was a misperceived government policy to eradicate poverty, the Community Reinvestment Act 1995. Sub-Prime lending rose sharply from 2005-2007 as reflected in the Mortgage Credit Availability Index(MCAI). The push for Sub-Prime lending to eradicate poverty resulted in the highest level of Household Debt levels relative to Disposable Personal Income recorded. In 2007 the T-Bill/10yr Treasury rate spread fell below 0.2% which was followed by a down-shift in lending momentum and the Great Recession. Dodd Frank legislation, another misperceived government policy, was in response to correct the earlier Community Reinvestment Act 1995. Mortgage lending has been historically low since the passage of Dodd-Frank regulations resulting in current Ratio Total Housing & Single-Family Starts to US Population levels remaining near or below levels recorded since 1959. Government social engineering policies have never produced the outcomes anticipated and policy makers swing from one bad policy to another. Frédéric Bastiat wrote “The Law”, 1850,http://bastiat.org/en/the_law.html in which he simply described government’s role as focused on protection of the people from outside hostile threats and to internal guarantees for fairness and equal opportunity. Whenever government initiates programs to engineer social outcomes outside these guidelines, history records a host of unintended and disastrous social disruptions. Often, these include financial collapses.

The recent drop in the rate spread to 0.2% in Dec 2018, lowered the MCAI sharply which now appears to be recovering. Current government policies favor continued economic expansion. The recent tax reduction, regulation reduction has resulted in a significant acceleration in employment and helped with exiting the manufacturing recession 2014-2016. Additional policy initiatives regarding global tariff reductions and efforts to expand mortgage lending could further stimulate the economic expansion. There is a decent likelihood that these efforts will prove at least partially if not wholeheartedly positive.

With current levels of Household Debt levels relative to Disposable Personal Income, it would be very difficult to trip the current economy into recession. The rate spread shift to 0.2% recently was due to a rise in market pessimism resulting in a fall in 10yr Treasury rates and importantly not due to a period of excess speculation and optimism or a period of debt accumulation. This is not the stuff of recessions.

The Thesis for Equity Investors:

The current economic conditions remain favorable for earnings expansion leading to higher equity prices. The highest levels of pessimism are present in industrial and consumer discretionary issues as investors anticipate recession. It is the discrepancy between market psychology and economic trends which creates a strong investment opportunity in the most depressed equities.

The recommendation is to be positive but be selective. This is a very good time to add to equity positions.