We are up 105% in DTO so far and it looks like there are more profits ahead.

“Davidson” submits:

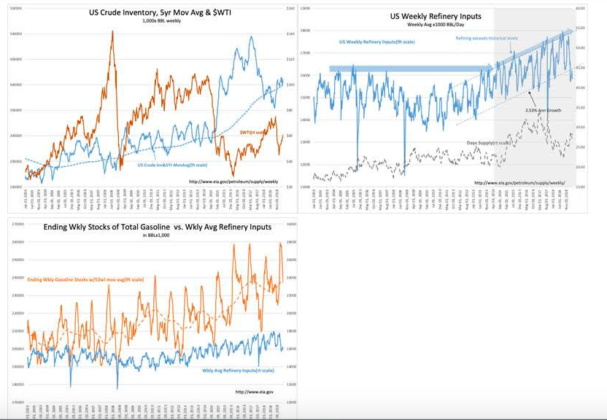

US Crude Inventories rose by 10mil BBL on weak Refining Input causing sharp draw on gasoline inventories, but oil prices are higher. This appears to be an atypical response, but the larger theme is rising confidence in continuing economic expansion supported by better than expected economic reports and corporate financials. It is the improving perception of economic activity based on rising equity prices which Momentum Investors have more recently correlated via algorithms which is driving oil prices higher.

The algorithmic relationship between $WTI and the SP500 which was minor in the 2014 collapse has become amplified recently. The recent period Oct-Dec 2018 in which “Great Depression” fears rattled investors and saw oil prices collapse with equity prices continues to see the same correlation as SP500 recovers on fundamentals and carries oil prices higher. The 10mil BBL rise in US Crude Inventories has been ignored as a bearish signal and overcome by the equity price rise as a bullish signal.

Current algorithm correlation: Higher equity prices = Higher oil prices

The recent changes in market psychology from overly pessimistic levels should propel equities and $WTI higher in my opinion.

One must ever be aware of shifts in investor perception. The past often does not repeat!

To access paid content at our original 2009 prices, click here