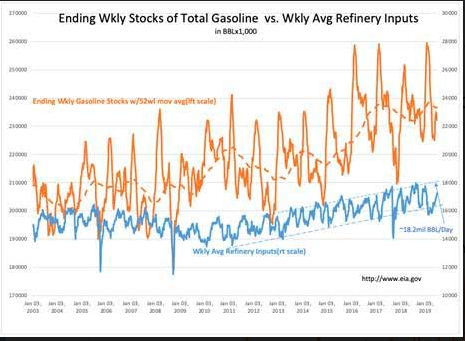

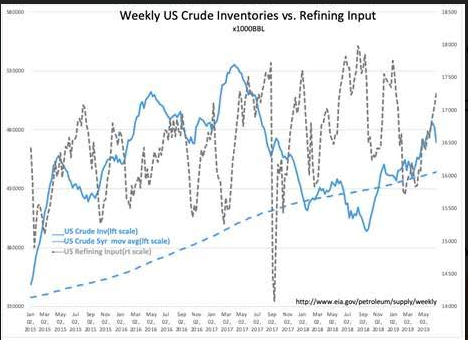

As we’ve been saying for a while now, as refining inputs increased to more normal levels, inventories would fall…

Today the data showed US crude inventory fell 12.79mil bbl (the largest decline in almost 3 yrs). Expectations were for a 2.8M bbl draw. While refining inputs are rising, they have stayed relatively low historically. Gasoline inventories are falling with summer demand. We currently remain ~25mil BBL above the 5yr avg. US crude inventory trend, but not for long.

Don’t forget… Exxon (XOM) is not back online with its 600,000bpd refinery…. when that starts up, inventories fall….fast.

To access member-only content at 2009 prices, please follow this link.