“Davidson” submits:

Capital flowing to US from Emgerging and Developed Markets are keeping US$(US Dollar) elevated and rates unusually low as early success with US tariff initiatives, with Mexaco and Canada,cause global investors to anticipate success with China and other tariff initiatives. Capital flowing into European markets has resulted in negative interest rates as these markets have less capacity to absorb it than capacity in the US. Capital seeking safer havens is part of this flow as corruption and autocratic leadership impacts Emerging Markets. Capital from Emarging Markets not having a traditional equity experiende has sought out Sovereign Debt and real estate as asset classes. This means companies will likely have to adjust to current US$ levels and low rates for some time as it becomes apparent that there is a new global trade regime being put into place.

Investment opportunities have lessened in countries with highest tariffs and expanded in countries which benefit from lowered tariff barriers. The net result is very positive for US based manufacturing long-term. How long this process takes before global capital flows have adjusted is impossible to predict with any certainty? The current level of tariffs and state of global trade relationships has a 50yr development history. It will likely take decades to rebalance even after new tariff levels have been established.

To access member-only content free for 5 days at 2009 prices, please follow this link.

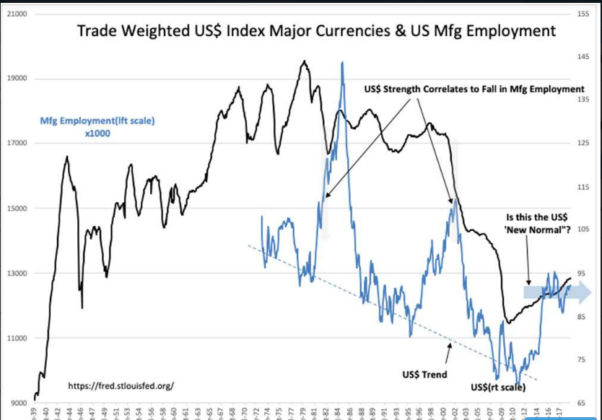

The history of US global trade relationships and stability of the US$ is reflected in the history of the Trade Weighted US$ Index Major Currencies & US Mfg Employment. On first glance it appears that the the US$ has deteriorated since the early 1970s as global trade has grown. Deeper analysis and historical review of trade history, geopolitical events and technological invention/innovation quickly dispells the initial perception. The long-term decline in relative value of the US$ to its major trading partners, the importance and number of which has widened over time, is due to US exports of innovation and manufacturing to lower-cost countries and importing products too expensive for native manufacturing as the US standard of living rises. The net result is to raise the value of the currencies of its trading partners (raising trading partner GDPs as well) in the process thus lowering the relative valuation of the US$. In the process the US$ is recognized as the most trusted global currency. The US$ is the currency that best holds its value. As global trade has expanded, countries with nacent economies raised tariffs to protect home markets from US competition. The US in response settled manufacturing sites in these countries to produce locally and avoid tariffs. This resulted in a net transfer of employment opportunities, GDP and standard of living from the US to foreign countries. As the global trade expanded, so did global wealth and the trade-weighted value of the US$ declined even as the US$ gained recognition as the strongest most trusted global currency. Letting trading partners raise trade barriers to US production was a political consideration of broadening trade even if it cost US manufacturing employment. History shows that US Mfg Employment began to stall in the early 1970s as the US$ gained importance as a global currency. The additional cost to US Mfg Employment is obvious with every period of US$ strength which followed the 1970s.

It is important that the most recent bout of US$ strength beginning in 2014 did not result in a decline of US Mfg Employment. Since the mid-1980’s. a new approach to improving US global competitiveness has gradually been taking hold in US businesses. It is called ‘Lean Manufacturing’ and relies on management engaging all employees as equally important in the business process. Management began to recognize that employees carried broad intellectual value to improve manufacturing and business functionality when properly engaged resulted in faster and lower cost responses to changing business climates leading to higher levels of profitability. Employee engagement was fostered thru substantial participation in the new profits produced. Gradually, it became obvious that the companies paracticing ‘Lean’ dealt better withcompetition and business disruptions. The first signs that ‘Lean’ had begun to have a significant impact on US Mfg Employment was heralded by the first Mfg Employment recovery in 2009 since the early 1990s. The advancement of ‘Lean’ as an important advancement in US manufacturing was underscored in 2014 with no decline on a significant rise in the Trade Weighted US$ Index Major Currencies. Since then, US Mfg Employment has continued to rise as US taxes and regulations have been relaxed.

Rates are like anything else in markets. They are set by market psychology. Emerging Market capital is low-cost capital primarily because safety of capital is more important than return on capital. Part of the Emerging Market capital calculation has been the deterioration of home country political/business environment and the risk of collapsing currencies relative to the US$. . As the US pursues lower global tariffs, capital will have greater opportunity for returns in the US as a producer/exporter. Capital should continue to flow to the US and keep rates low for some time.

Much of the current advice is to invest in Emerging Markets. But, the impact of current US policies on global capital allocation favor long-term US growth!!

To access member-only content free for 5 days at 2009 prices, please follow this link.