“Davidson” submits:

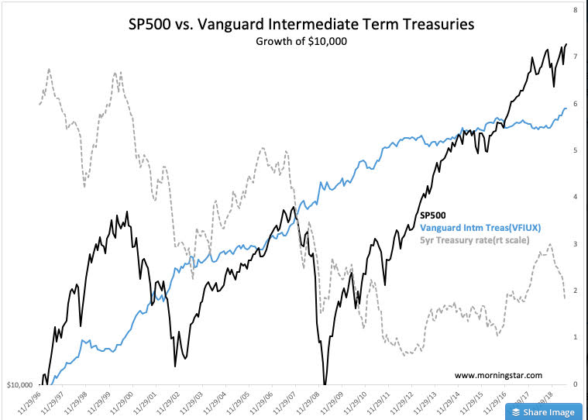

Since Nov 29, 1996 the Vanguard Interm Treasury (VFIUX)grew from $30,395 vs SP500 $39,320 for the same period, Data from Morningstar. The 5yr Treas rate is shown because some of the gains in the bond fund came from capital gains as rates fell and the fund itself was managed for duration.

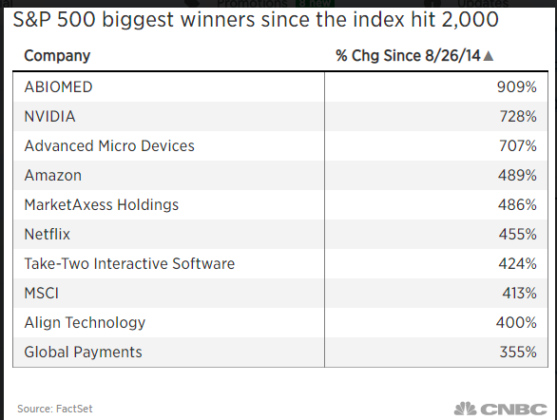

A list (below) of the top performing SP500 issues from SP500 2,000 to 3,000 or Aug 26, 2014 were all Momentum issues that the average investor would never have added to their portfolios. Momentum issues being added to indices during every market cycle skew the results upwards while in the cycle uptrend. Later the pay back of these issues is often on the level of 95%.

The mix of falling rates for the Vanguard fund and additions to the SP500 of Momentum issues make neither useful measures of overall market performance of anything.