“Davidson” submits:

1) US Crude Inv falls 10.8mil BBL. ~500,000BBL below the 5yr mov avg.

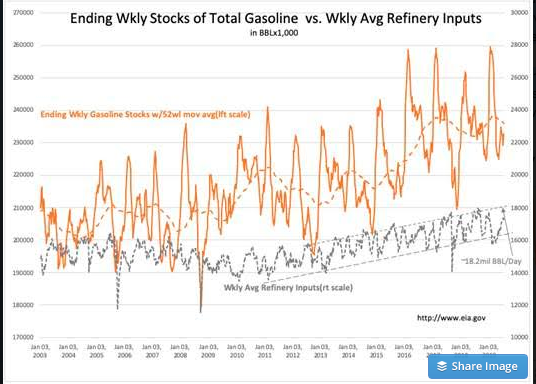

2) Refining inputs remain seasonally low by ~1,000,000BBL/Day.

3) Gasoline Inv fall by 226,000BBL

Exxon’s Baytown ~600,000 BBL/Day refinery restart does not appear to have been added to refinery inputs as yet. Current refining inputs are ~1mil BBL/Day below typical seasonal levels of 18.2mil BBL/Day Gasoline Inv fell by 226,000BBL and remain unusually below levels typically maintained during the summer driving season.

The single most important relationship in this data is the correlation beginning fall of 1997 of $WTI (West Texas Intermediate price) with the levels of weekly US Crude Inventories vs. its 5yr mov avg. Since 1997, it is apparent that traders equate US Crude in shortage whenever weekly inventories fall below the 5yr mov avg and drive prices higher. Whenever weekly crude inventories exceed the 5yr mov avg traders deem oil in excess and drive prices lower. This thinking appears to have only strengthened in recent years.

Many have equated oil prices to economic activity much like copper used to be termed “Dr Copper”. Higher oil prices are believed to reflect stronger economic demand and therefore a good general stock market predictor. The long-term data does not show wild swings in oil demand even during recessions. Oil supply/demand tends to grow 1.75% annually with mild fluctuations being a commodity used in the production of basic food and service transportation needs which grow with populations and advances in standards of living. The wild price swings observed in oil prices can be attributed more to Momentum Investors investing with top-down themes than to variables of economic activity.

With this background in mind, the recent decline in US Crude Inv leaves us ~500,000BBL below the 5yr mov avg. This is occurring without the full impact of Exxon’s Baytown refinery delayed restart during the seasonally high-demand driving season. Investors can expect a period of high crude inventory draw-down as gasoline inventories are built back to seasonal levels. Such a draw on crude inventories should rapidly pull them well below the 5yr mov avg and if traders maintain their past behavior should result in significantly higher $WTI.

Access member-only content FREE for 5 days here. Use code “VP30” for 30% off at checkout.