“Davidson” submits:

Investing is the task of separating misperception from fact and market psychology from business and economic fundamentals. The goal is to ascertain when the market psychology of a misinformed consensus differs enough from economic and business trends to provide investment opportunity. The foundation of investing is the basic understanding that market prices are driven by market psychology which in turn is driven by economic and business fundamentals. So much misinformation persists that many believe market psychology drives economic activity. This perception comes from shorter-term perspectives and not the long-term perspective that is required. The blame for ‘short-termism’ rests squarely on a wide acceptance of Harry Markowitz’s Modern Portfolio Theory (1952) and the assumptions that past market performance repeats and can be used as future guidance and even measure quarter-over-quarter performance.

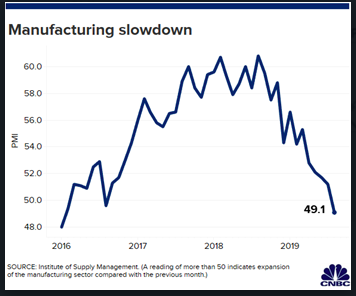

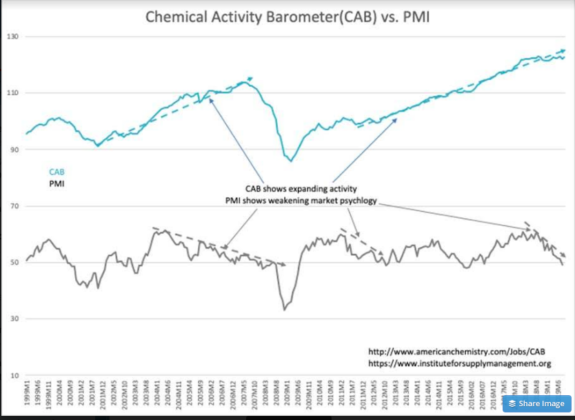

The more market analysis has pursued a mathematical solution the more it has disconnected itself from fundamentals. In the process other measures are believed to supply better indications of economic activity such as the price of copper, ‘Doctor Copper”, the price of oil and opinion surveys such as the Michigan Consumer Confidence, Home Builders Survey and the Institute of Purchasing Managers Survey with its Purchasing Managers Index, the well known PMI. In the current environment, many have called for recession based on weak PMI. The media, as shown, has exaggerated the shift in PMI to underscore the many recession forecasts. Unfortunately, none of these indicate the condition of economic fundamentals only the consensus opinion which as usual is misleading. The Chemical Activity Barometer(CAB) is a good remedy for misperception.

US manufacturing contracts for the first time in three years amid China trade war

SEP 3 2019 https://www.cnbc.com/2019/09/03/the-manufacturing-sector-is-contracting-according-to-ism-survey.html

CAB was reported at 122.83 today with past 2mos revised higher starkly contradicts the PMI recession signal. The difference between the CAB and the PMI is that the CAB is based on a composite of hard measures of activities of chemical production and end use:

https://www.americanchemistry.com/Chemical-Activity-Barometer-Fact-Sheet.pdf

The CAB is a composite index which is comprised of indicators drawn from a range of chemicals and sectors, including chlorine and other alkalies, pigments, plastic resins and other selected basic industrial chemicals. It first originated through a study of the relationship between the business cycles in the production of selected chemicals and cycles in the larger economy. Other specific indicators used include:

- Hours worked in chemicals;

- Chemical company stock data; publicly sourced, chemical price information;

- End-use (or customer) industry sales-to-inventories; and

- Several broader leading economic measures (building permits and ISM PMI new orders).

The CAB is comprised mostly of fundamental measures including pounds of materials produced and shipped and is measure of things produced in real time. The PMI is a sentiment indicator of individuals(Purchasing Managers) anticipated business conditions. They have often provided divergent signals just as today. The CAB remains in uptrend since 2009 as the PMI (falling sharply) calls for recession.

For investors it is important to know if a recession is just ahead or is there continued economic expansion. ‘Hard data’ drives market prices long-term. Even bouts of pessimistic market psychology with their market dips give way to ‘hard data’ long-term. If one is a close observer, the PMI itself is a better indication of market psychology than of economic activity.

Periods of pessimism have always proven a good investment opportunity when they diverge strongly from fundamentals.