“Davidson” submits:

Once again, several well-known Momentum Investors forecast that a dire market lays in wait for investors the next 12mos. Their forecasts for declines the past several years have not proven correct and will likely be the same currently. They are price-trend followers who make economic calls based on market prices believing that prices reveal all known information public and non-public that one needs to know. They are known for frequent changes in their media commentary as prices shift. The belief is that prices reflect market psychology and that market psychology controls economic activity. Sounds logical as they frame it, but if one examines the economic data over many cycles, it becomes clear that market psychology is determined by economic data, corporate financials and geopolitical headlines after these items have been reported in the media. Restating this concept differently: market psychology drives prices after economic trends, events and corporate earnings become media headlines. Market psychology lags existing conditions only once they become known. Psychology does not forecast.

When prices lag as they are today, Momentum Investors take these cues to forecast that market declines lay ahead. Market psychology has slipped into indicators deemed ‘economic’ on which many investors rely. Indicators such as the Michigan Consumer Sentiment, Purchasing Managers Index, Home Builders Index, the American Assoc of Individual Investor Index and etc measure changes in market psychology. These are not economic indicators, but sentiment indicators which swing even with headlines that have no economic impact. This leads to multiple shifts in investment forecasts which are later proven incorrect. But, who is paying attention!

Value Investors remain positive currently. Value Investors focus on basic economic and business activity. Value Investors recognize the role of market psychology in prices. Their approach differs in that they recognize it is economic and business reports which drive the headlines which in turn drive market psychology which in turn drives price activity. By monitoring economic and business fundamental trends, Value Investors can anticipate the headlines by several years. Value Investor commentary does not shift quarter-to-quarter. Value Investors do not drive the day-to-day running shifts in commentary which drives media viewership.

The difference between Momentum vs. Value Investors is that Momentum approach relies on market psychology while the Value approach relies on ‘hard-count’ economic and business data which drives market psychology. In predicting market psychology, Value Investors accept that while economic trends plod ahead, market psychology typically shifts from overt optimism to overt pessimism and back again multiple times during a cycle. Every time market psychology becomes overtly pessimistic during a period defined by economic expansion, Value Investors turn more optimistic about identifying attractive opportunities.

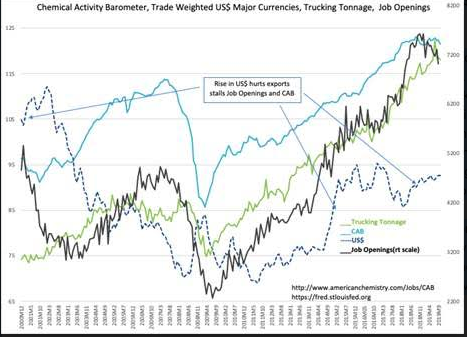

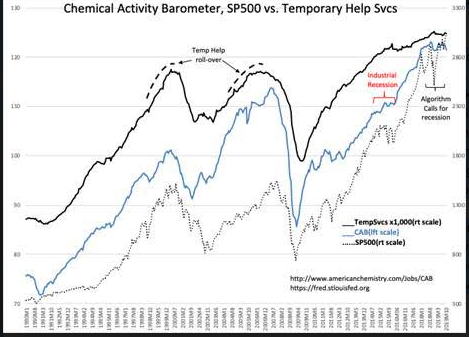

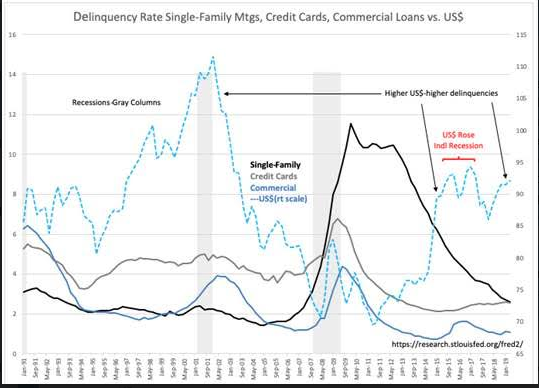

The trends of the monthly Chemical Activity Barometer(CAB), Job Openings, Temp Help Svcs, Trucking Tonnage and the US$ compared to the quarterly Delinquency trends of Single-Family Mortgages, Credit Cards and Commercial Loans show we continue to be in an improving economic climate even with negative impact of a strong US$ in manufacturing and energy sectors. With the exception of the US$, each of these indicators represents a ‘hard-count’ of economic activity. The recent US employment, retail sales and personal income data likewise continue in uptrends hitting new highs every few months. Falling delinquencies on debt even with some difficulty experienced in US$ sensitive industries is impressive. The overall pattern reveals that difficulties have been and continue to be temporary.

What pessimistic forecasts miss is the significant decline in regulatory costs which is itself strong fiscal stimulation. Most calling for government economic stimulation think of it as ‘more’ spending. Regulation reduction costs taxpayers nothing and may even lower costs to government. Regulation reduction where it makes sense levers corporate flexibility which frees corporate capital for new hires. One of the hidden features of the current environment in the US is the implementation of ‘Lean Mfg Processes’. This approach, which combines employee engagement with compensation, when executed well leads to doubling production in one-half the manufacturing footprint. This is evident in corporate profits this cycle. The old models expecting to see capital equipment spending have been disappointed as existing equipment is used more efficiently. It is becoming recognized that managements who view human capital as their most important resource have the best outcomes.

There are significant additional policy shifts in process for regulation reduction and tariff fairness. The impact is likely to be quite positive, even if not entirely predictable. Market psychology will alternate as it has, but as long as economic and business uptrends remain intact, equity prices have always been priced higher once positive results are reflected in the headlines. Investors must monitor the important ‘hard-count’ indicators and invest with the better companies. There will be signs at some point that the cycle is coming to an end. Just not today!