“Davidson” submits:

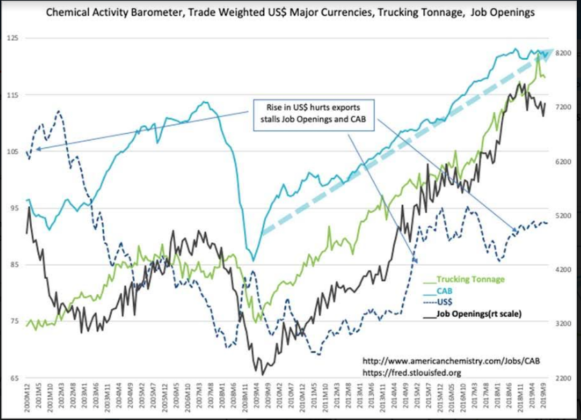

Job Openings(JO) a harbinger of employment has turned higher with a revision higher for the prior month. The sensitivity shown between the Chemical Activity Barometer(CAB) and JO indicates that US$(US Dollar) strength weakens the US manufacturing employment which has been a key component of JO.

US$ strength weakens exports of High-Value Exports which in turn weakens Manufacturing Employment and in particular JO in the current cycle.

Every cycle has its own relationships between economic indicators dependent on Domestic policies of the current administration, embedded policies sometimes decades old and shifting geopolitical events. This is why making predictions on past cycles proves such a quagmire. The best one can do in my opinion is to understand the fundamental drivers of the current cycle, understand where investor responses are misinformed and allocate capital where fundamentals indicate the prices paid are the cheapest. It does not mean one will not see a weaker market response than expected to financial reports. Market psychology has been built into algorithms which react to the first few words of headlines. Lately, pessimistic headlines drive prices lower even when the body of the report proved it deserved a more positive response. It seems the media is plagued with advisors making broad market forecasts on single economic reports. This is like an artist painting a rainbow with one color and calling it reality. Modern Portfolio Theory(MPT), the basis of algorithmic investing, works like this. A big mistake! MPT never has predicted the next societal innovation leading to unimagined businesses. Few if any predicted the Internet of the 1990s which led directly to Apple’s iPhone in 2007 followed by the Smartphone industry which in turn created an explosion of individuals having access to global information which in turn led to 2010’s “Arab Spring” by oppressed people demanding human rights. Who would have thought?

Investing cannot be simplified to mathematical models. Every country has unique characteristics as does every company. The best one can do is to identify corporate managers with a history of good capital allocation decisions and successful adjustment to unexpected business environments. Then one should be careful to invest at discounts to the particular business record within the context of an expanding economy. Today, even with a strong US$ stalling somewhat US manufacturing, it appears managements are adjusting and beginning to advertise for new hires as we exit the pessimism of the past 12mos.

Equity prices should be priced higher as investors come to realize that the US economic expansion continues.