“Davidson” submits:

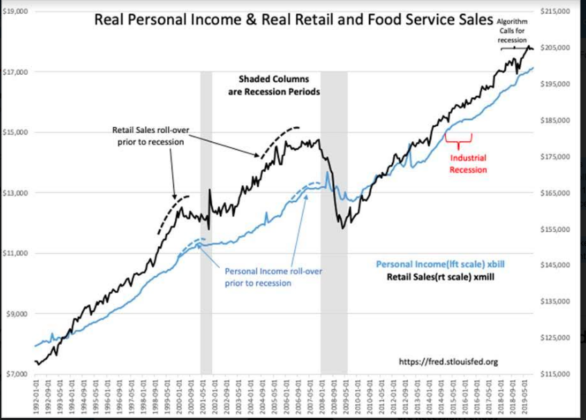

Our recent 12mos should prove to be one of the most valuable investment lessons of the past 10yrs. Today’s Real Personal Income(RPI) posting a new high stands in sharp contrast to the past 12mos of excessive pessimism. RPI is one of the key indicators which roll-over prior to a recession. The data for RPI not only remained on trend but even bumped higher during the middle of the market correction Oct 2018-Dec 2018. If you recall, the media was awash with advisors declaring this to be “1929” all over again. Pessimism rose to likely the highest level of this cycle since 2009. Investing requires being able to make unemotional decisions when everyone else has leaned heavily in the same direction.

Even though there has been some shift away from extreme pessimism investors continue to remain highly skeptical. Low rates are a sign that significant cash has moved to and remains on the sidelines. Once investors become convinced that economic expansion continues, capital should shift out of Fixed Income and drive rates higher as they seek higher returns in Equities.

All looks good for Equities in my opinion.