Remember how everyone in 2010-2019 wished they had invested in the market during the great recession? Well, for those who missed it, you are getting a second chance now. Fortunes are made in bear markets for those willing and able to look past the panic.

“Davidson” submits:

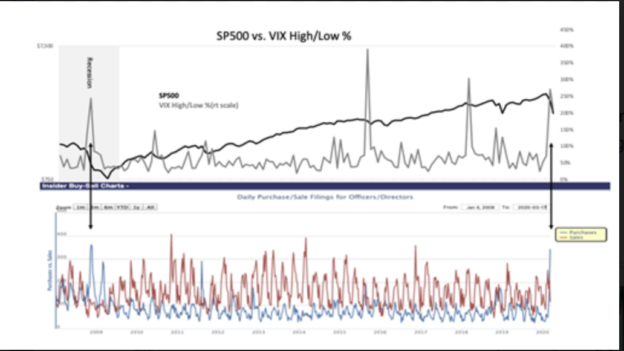

Periods of great market stress have always been good periods to invest fresh capital. This is one of those periods of high stress. CEOs and CFOs are buying shares at levels last seen in 2008, the “Sub-Prime Crisis”. Markets never repeat and while the 2008 crash by itself provides little guidance for 2020 it holds the same historical lesson of every great correction. That lesson is we recover! We have always recovered and it is this that corporate managements understand even without knowing precise outcomes the next few months. Investment advice, “Should I invest, should I not?” is the backbone of an advisor. Now is a good time to invest.

Even though we have no previous experience with COVID-19, the threat levels are not supported by the data. The early infection rate fears of 80% have already in a few weeks been reduced as multiple treatments have emerged. The press continuously stresses the most dire outcome, but the actual numbers (as of 3/30/2020) show 0.013% https://google.org/crisisresponse/covid19-map To place this in context the US routinely experiences 20%+/- flu infection rate or near 60mil individuals. Last year 60,000 in the US died of flu. With extensive testing, the US population is currently experiencing a COVID-19 infection rate of 0.04% or well, well below the 20% rate typical for flu.

The current panic has driven SP500 prices relative to the Value Investor Index not seen since 2008. The Value Investor Index is named so because Value Investors are most active buyers when the SP500 is priced near or below the index. Corporate insiders are deemed the most informed of this group of investors. It tracks the historical fundamental valuation level of the SP500 based on long-term earnings and long-term Real GDP growth rates across multiple cycles. One can also think of the relative price of the SP500 to the Value Investor Index as a measure of market psychology. Value Investor buying has a long history of creating market bottom. A bottom more or less is what we have today. Not a precise price point, but the range we are seeing today.

No one ever rings a bell at the bottom.

Pessimism creates market buying opportunities if one has a plan of attack. I advise investors to consider new capital allocations to equities. It is a good time to be positive and do a general review.

It is time to do something more than a general rebalancing.