It will be interesting to see how this plays out. While Davidson is bullish on 2020-’21, I am fearful. I will continue to post his comments as he been spot on in the past (nailed the March 2009 low) and through the recovery. While virtually every other prognosticator the last 10+ years have called for recessions, he has been steadfast we would not have one (he was 100% right). For that reason, I continue to post even though I disagree to a point. My assumption is readers are smart enough to digest both cases and make their own decisions. I think people are missing the larger point in the data. While we HAVE improved, we are still dramatically below where we need to be.

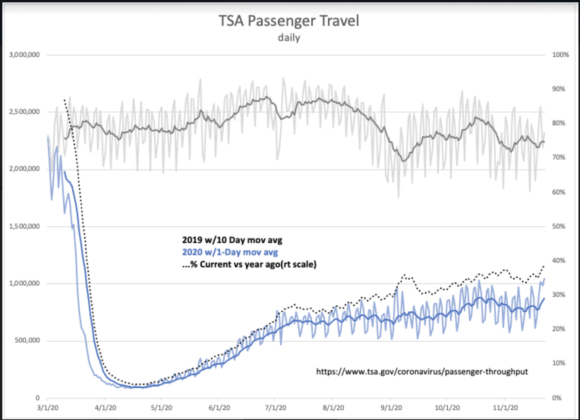

Take air travel:

While it of course has improved, the industry is still being decimated and nothing on the horizon looks to improve that currently. Other industries are seeing the same thing. I think the bumps we are seeing in the data is simply repressed spending on necessities and inventory restocking. I expect the data to begin to flatline or reverse in the coming months.

That said I am not expecting a 2008-09 scenario but I am very worried about market levels here….

“Davidson” submits:

Which comes first, the chicken or the egg?

Many believe market psychology drives the economy. They believe higher equity market prices drive economic activity because people become more optimistic when they see their wealth growing. This is the basis of ignoring fundamentals supported by many Momentum Investors whose investment decisions are based on price trends. Value Investors staunchly believe that fundamentals are the underlying drivers of prices once financial reports become public. The evidence supports both. There are periods when market psychology drives economics which drives prices and periods when fundamentals drive market psychology which drive prices.

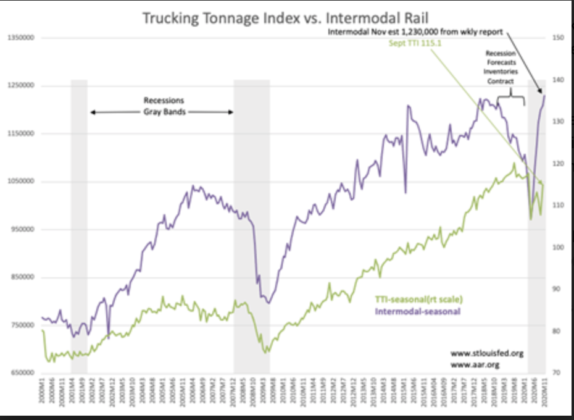

What is common to Momentum and Value Investors is that prices are driven by market psychology. The connection to whether it is psychology or fundamentals come first with regards to economic activity has been argued long and hard. The answer as shown in Inventory/Sales ratio and Trucking Tonnage/Intermodal Rail (TTI/IR) indices is that either can have a short-term impact on the other and drive prices accordingly. Longer-term the Value Investors are correct, but it can take a couple of years of their assumptions looking wrong.

The inventory and goods transport data are correlated. In 2018-2019 we witnessed a drop in the 10yr Treasury Rate developing a negative T-Bill/10yr Treas Spread in 2019. In turn this triggered many algorithmic signals leading to a host of recession calls. In Dec 2018 one forecaster declared we would experience another ‘1929’. They were wrong and we did not but this spate of negativity caused a drop in business inventories by businesses using market forecasts in business planning. Less inventory reduced Intermodal Rail loadings even though monthly Retail Sales were hitting new records. It appears that just-in-time trucking made for timely and flexible replenishment over rail.

The net/net condition prior to COVID-19 was a falling Inv/Sales ratio. Then came COVID-19. This caused many to raise home stocks in anticipation of lower availability of needed goods which drove Inv/Sales to historic lows in the 1.22 range. Coming out of the COVID-19 lockdown, the replenishment need soared as recovery became clearer which has resulted in a rapid return of both TTI and IR with the latter showing a faster recovery (from a deeper low).

While fears of recession 2018-2019 (which did not occur) caused a temporary drop in business inventories and goods transport, the recession recovery from the COVID-19 (a fundamental economic dynamic despite overly pessimistic market psychology) is now driving a shift from pessimism to optimism and higher equity prices as fundamental reports emerge. Fundamentals longer-term drive investor psychology even though psychology can drive some business decisions short-term. Investing long term must be geared to assessing which factors are important at any point in time.

Economic recovery continues. How one knows this is by following counts of individuals employed, goods transported and Retail Sales. Every day one needs to separate media commentary from factual data and to be able to judge which data has higher reliability. The ‘mind-over-matter’ does have an impact but is temporary. Longer term it is always fundamentals.

Equity markets are headed higher in my estimation with higher employment, higher Retail Sales, a normalization of Inv/Sales ratios and etc. driving investors ever further from the current level of pessimism.

Intermodal Rail traffic is at a record high. Economic expansion continues. Equity prices likely higher.