The S&P is by no means in a bubble…..it also is by no means “cheap”.

“Davidson” submits:

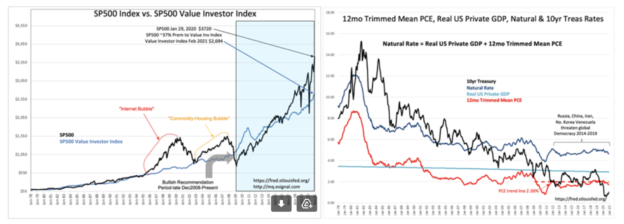

The SP500 is a 37% premium to the Value investor Index with 12mo Trimmed Mean PCE reported at 1.74%. Based on the history of SP500 with this fundamental valuation indicator, the SP500 can still rise by nearly 100% before it reaches the past levels indicating a cycle peak.

Inflation continues to trend well below 2% and the more recent reports have been below 1.75%. Capital pooling in Western nations for safety have kept Sovereign Debt rates low with some not having capacity to absorb the level of capital driving rates into negative territory. If Democracy were to break out globally, some capital would flow out of the US and other Western nations and cause rates to rise. We do not appear to be in any danger of that occurring in the near future.