“Davidson” submits:

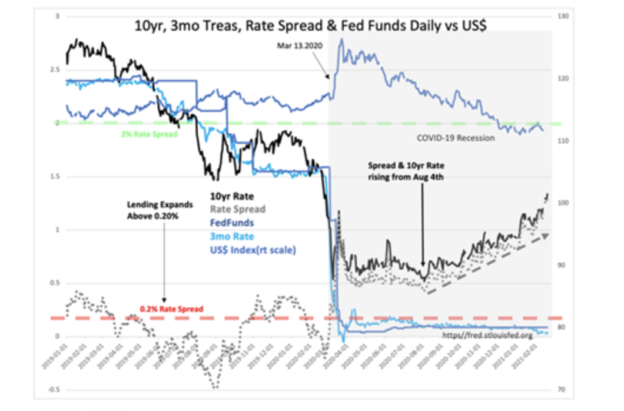

The CNBC commentary, from a long time NYSE trader, is “investors worried Fed has lost control of rates…markets” as rates rise. The daily chart from 2019 thru this morning shows a recent rise in the 10yr Treasury rate to 1.5%+ and a rise in the T-Bill/10yr Treasury rate spread to 1.35%+. There has been a well-worn misperception that the Fed controls rates and stock markets with many decades of history. The data supports the opposite view that the Fed follows T-Bill rates with their adjustments to the Fed Funds rate.

Rising rates reflect investors shifting capital out of fixed income into other assets believed to offer better risk/return parameters. Market history from 1953 has provided support for rising rates = rising equity prices as long as the T-Bill/10yr Treasury rate spread is widening as it is currently.

A widening T-Bill/10yr Treasury rate spread is very positive for higher equity prices.

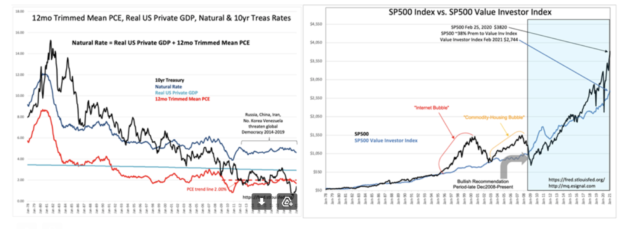

Higher rates are also ascribed to rising inflation with reports that inflation is rising rapidly. The Jan 2021 12mo Trimmed Mean PCE was reported at 1.68%. Inflation at the moment is still being impacted by the past administration’s huge drop in Federal regulation. This is the lowest inflation since April 2011.

Less regulation = lower inflation

Low inflation over time results in higher valuation for the SP500 earnings, all things being equal. Investors have over time, even with wild swings in market psychology to specific events with multiple misperceptions thrown in the mix, priced the long-term SP500 earnings trend using a capitalization factor comprised of the Private GDP + 12mo Trimmed Mean PCE. Lower inflation in the capitalization factor prices the SP500 higher even with significant swings in market psychology.

Lower inflation = higher equity prices

The SP500 is a ~38% premium to the Value Investor Index(capitalized SP500 earnings trend). Market peaks in 2000 and 2007 saw the SP500 at 100%+ and 65%+ premium respectively. The relationship with the Value Investor Index is dependent on market psychology at the peak of investor enthusiasm. There are other factors which tend to correlate with market peaks. The SP500 ~38% premium is considered moderate with current economic conditions.