“Davidson” submits:

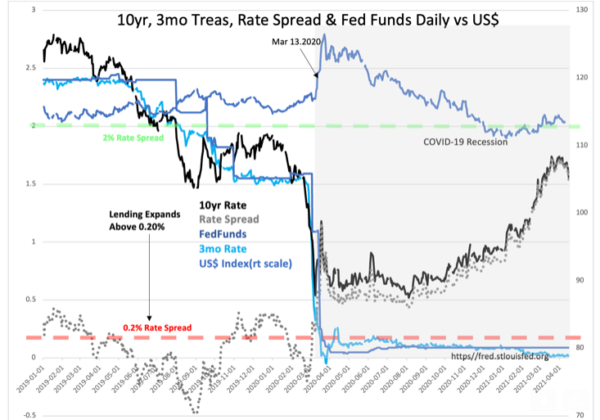

Most seem not to use the T-Bill/10yr Rate Spread (Dotted Gray Line) as I do. There is a long history from 1953. It reflects market psychology, a narrow spread in recessions indicates high pessimism, but a narrow spread also results in market/economic peaks.

It works like this.

- Recession reflects high investor fear and also high lender fear. Narrow rate spread (0.2%) makes lending difficult but to highest quality borrowers

- Slowly some investor fear subsides and they sell 10yr Treas for equity beginning the rate rise cycle. T-Bill rates remain low as investors keep ‘safe money’ pooled in T-Bills The rate spread widens reflecting beginning of improvement in market psychology

- Confidence builds and rate spread widens which improves lending profit and business begins to borrow to refurbish/expand.

- Several years into business cycle rate spread widens to 2% or higher and confidence improves such that investors begin to commit capital stored in T-Bills and now short and longer-term rates are rising. Equity prices are soaring and business booming.

- Eventually, investors become more speculative chasing equity/other returns and drive T-Bill rates so high that the rate spread narrows back down to 0.2% which restricts lending and speculative projects fail. Recession occurs.

Investing works in a cycle of market psychology which one can track with the T-Bill/10yr Rate Spread. Excess speculation is shown when investors abandon the safety of T-Bills for equity exposure and the rate spread narrows to 0.2%.

This scenario was not followed 2018-2019 when recession fears soared as 10yr Treas rates fell towards T-Bill rates. This was foreign capital seeking a safe haven from autocratic governments, not a rise in market psychology. The directional nature of rate shifts is important. Algorithmic traders saw the yield curve inversion and forecasted recession which did not occur till government shut the economy down for COVID.

With rising rate spread, the economic context is very positive and should continue for 3yrs-5yrs barring government interference. One can monitor the investment cycle using the rate spread.