“Davidson” submits:

Without performing a complex analysis of too many shifting factors to properly quantify, the simplest approach is to look at expected fossil fuel liquid production vs. $WTI to guestimate revenue growth and the market pricing response. The factor which is unknown is how much more efficient any company may prove to be this cycle vs previous cycles. Well-operated companies have nearly always added operating efficiencies which tend to surprise on the upside. XOM& EOG fit this description. Already there is reported and anecdotal information suggesting ~70% lower costs to production than 5yrs ago for each. Some cost reduction is from operating procedures and some is from technological innovation. How much impact on improved cash flows will be unknown till we are in a full throated expansion of the energy cycle. As unemployment falls globally with one country after another exiting COVID shutdowns, economic normalization and energy consumption will return to pre-COVID levels.

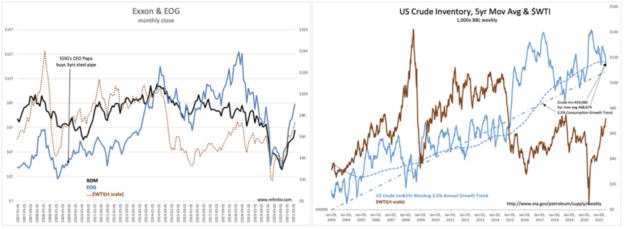

In estimating the impact of cycle normalization, the simple approach is to assume companies will resume pre-COVID liquids production and that cash flows and investor response remain more or less coupled as in the past. Relating $WTI to share price is useful. $WTI prices at $73/BBL today relates to EOG and XOM 2018 prices of $125shr and $85shr respectively. From current levels, these prices represent 30% potential portfolio gains. Unknown, is the impact on $WTI of 7yrs of underinvestment the industry has had to manage since the 2014 $WTI plunge.

Today, E&P cos are producing at ~20% less than 18mos ago while consumption is normalizing. The industry has lowered finding costs ~70%. The crude inventory build post 2014 and partially revisited during the COVID shutdown has forced conservative operating stances even as inventories drop sharply towards the historic 3.5% Annual Growth Trend representing previous low inventory levels. $WTI is the likely key to stimulating higher production once it comfortably reaches and holds at a level that promotes additional supply. Only corporate management knows what that trigger price is. This far, the rise in $WTI has not resulted in higher crude production and crude inventories are falling near 8mil BBL week-over-week. In 2wks, US Crude Inv is likely to fall below the 3.5% Annual Growth Trend connecting past low inventory periods.

There are multiple forecasts for $100/BBL oil prices. Should this occur in the current cycle, EOG and XOM are likely to be priced accordingly. Pricing is less a mechanical process and more based on market psychology dependent on how long an investment concept has been out of favor vs. how dramatic the perceived change is at hand. There are always unknowns. That nearly 100% of goods and people transport is dependent on fossil fuels which consumes 85% of fossil fuels makes alternatives impossible. $WTI is as much determined by market psychology as any other price. The presence of a 10 fold larger futures market with a sudden shift towards speculative frenzy can make it soar above the prior highs. The potential that this could occur is possible.

Fossil fuel related cos are recommended portfolio suggestions at this time with EOG & XOM as well-managed E&P companies and RES and SDPI as smaller service-related suggestions.

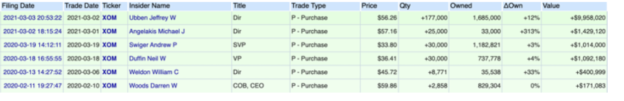

The insider activity in XOM is appropriate at this time in my estimation.