This was crypto’s moment to shine and prove the entire thesis behind it…. it failed spectacularly, utterly, and without any plausible explanation.

“Davidson” submits:

The daily trends in currency exchange in the EURO and Yuan, representing two large US trading partners, reflect capital shifting to the US$. The headlines indicate weakening economic conditions and, if one interprets government actions as the basis, the source has been directly tied government policies. The Dutch farmer protests and continued COVID lockdowns in China are interspersed with collapsing property values in China and disruptions in Russian natural gas which have grave geopolitical overtones. Investors have voted for the US$ as a safe haven.

For the Eurozone which has been scrambling to import US LNG, this has contributed 20% additional cost to their energy supply weakened by a decade of dismantling traditional sources. For the US, this represents additional capital seeking higher investment returns that in turn provides liquidity and increased volatility. Global ability to shift capital can now be executed using a few strokes on a cell phone. What was once the venue only of institutions with slower moving strategically considered decisions has been joined by individuals acting impulsively to perceived immediate opportunities or threats. These are relatively newly-minted class of investors with little experience who in the main act more as price-trend followers. A prominent example of this is the unidentified investor who paid $69mil for an NFT(Non-Fungible Token) artwork believing it undervalued after profitably trading cryptocurrencies. https://cryptoslate.com/beeple-nft-sold-for-69-million-is-the-fourth-most-expensive-artwork-sold-by-a-living-artist/ The valuation was reportedly based on ‘uniqueness’ that someone else would value higher in the future like a van Gogh. While van Goghs are routinely exhibited to the public which maintains and builds an audience, NFTs are for the holder’s satisfaction and fall of the radar very quickly. The example of Jack Dorsey’s ‘first tweet’ may be setting the bar on these investments. First offered at $48mil, it sold at $2.8mil and in a recent auction was priced at $280,000. Not exactly a stellar return. https://www.forbes.com/sites/jeffkauflin/2022/04/14/why-jack-dorseys-first-tweet-nft-plummeted-99-in-value-in-a-year

These are anecdotes but observations of GameStop, AMC, cryptocurrency prices and activity on Reddit, StockTwits and Robinhood make it clear that there is considerable capital directed by groups of individuals with a similar focus acting in concert at times rivaling institutional activity. These investors are pure price-trend/social media followers completely disconnected from fundamentals. They invest using an alternate reality, are globally connected and part of the mix professional trading algorithms have been incorporating. Whatever it is that moves prices is not part of the consideration when potential for gain is based on capturing part of the price move without regard for the driver.

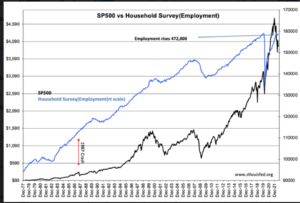

Longer-term investors must incorporate all market themes to isolate the longer-term fundamental trends from the volatility of traders and the associated misleading headlines. US$ strength is a longer-term trend coupled with volatile periods that brings more inexperienced Momentum trader capital into US markets. Recent 1,000pt moves in the Dow Jones Index on little news is the outcome. As long as positive fundamentals continue to filter into the headlines, as the employment reports did this morning, equity markets are anticipated to rise regardless of valuation metrics.

This is no measure of where employment will top this cycle, but the trend line for the Household Survey from 2009 in the current cycle indicates we remain 6mil underemployed vs. the current level. As the economy continues to drive employment, it appears that there is considerable distance yet to go. Foreign capital continues to chase price-trends and predicting a market top is impossible as it will not be based on any resemblance to fundamental value. The changes in fundamental signals will be the only warnings, but none today.

Equities remain heavily favored with fixed income to be avoided as investment vehicles.