“Davidson” submits:

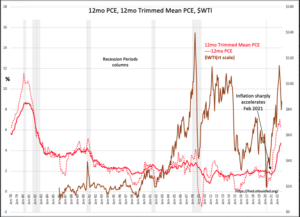

That crude oil prices and inflation have a correlation is long known. The issue like many misperceptions In financial thinking is which comes first and is oil causal for inflation or vice versa. The comparison 12mo PCE, 12mo Trimmed Mean PCE, $WTI spells out the reality. This is especially visible since 2002. The PCE inflation indicator includes energy prices. It is the 12mo Trimmed Mean PCE that is the Federal reserve favored inflation indicator as it smooths month-to-month spikes, hence the term “Trimmed”, making it less reactive to short-term fluctuations and more indicative of longer-term trends.

The clearly visible major price spikes to $120+/BBL in 2008, the period 2010-2014 and again in 2022 are each spoken of causal for inflation. It should also be just as clear that while there are corresponding spikes in the 12mo PCE, they did not prove of much inflationary consequence in the 12mo Trimmed Mean PCE. Not till Feb 2021 does there appear a causality of sorts repeated endlessly and connected to Russia’s invasion of Ukraine which did not occur till late Feb 2022 i.e., uncorrelated. It is funny how narratives are often formed which rarely fit the facts but make for authoritative media discussion.

The correlation that does hold if one is factually attentive and incorporates public events is that $WTI rises on inflation and shortage fears and falls on fears of economic correction. It should also be clear that no one is discussing that the inflation blamed on Russia in 2022 began Feb 2021 and further the price decline in $WTI from June 8, 2022’s $121/BBL to below $80/BBL today is not reflected in the 12mo Trimmed Mean PCE whatsoever.

Let’s stop blaming $WTI and people who need to get to work and make the correct observation that inflation is due to government policy. Oil has been the fall-guy for as long as there have been markets. This narrative is not correct.