Funny how we wake up one day and all the networks decide at the same time the market has turned and will be progressing higher.

“Davidson” submits:

Just like that, it is suddenly a “Bull Market”. Two weeks ago. the news was we were imminently facing a significant recession or we were already in it. How did this suddenly turn into a “Bull Market”? It seems market psychology can turn literally on a dime. The reality is far different and lost in the details unless one is actively looking. Declaration of either a “Bull” or “Bear” market is artificial. At some point the media and Wall Street have decided that a 20% price change in closing prices associated with a period of relative optimism or pessimism has been designated a turn from one to the other designation. It is a marketing ploy to keep viewers’ attention and sell advertising. The SP500 closed Friday at $4,304.88, 20%+ above the October 2022 closing low of $3584.13. At $4,300 they still called this a “Bear Market” but a couple of points higher it is suddenly a “Bull Market”. Most buy into this designation when the investment process is far, far more complex.

Ben Graham spoke of investors falling into two types, the “voting machine” (Momentum Investors) and the “weighing machine” (Value Investors). It is not at all that simple. Investors carry such a complex mix of biases, training and experience that no two are alike. Simplifying down to two designations is a grave disservice to anyone serious about understanding. They also simplify all stocks down to artificial designations i.e., the SP500, the Dow, the Russell 2000, Emerging Markets, which has led to ETFs claiming to focus on subsets of issues with specific designations. Couple corporate uniqueness (every business is unique) to every investors’ perspective being equally unique when the media presents glib forecasts based on slimmest basis of analytical effort to fit 15seconds of airtime and one gets an inkling of how much key information is ignored. The truth, however, is that every company is unique with unique business models and cultures while analysts make endless and useless comparisons using mathematical models ignoring this important detail. Analysts ignore the skillsets that make one company much better than its competitors. It is the successful skillset that makes one investment superior. Investing well is a complex process the explanation of which is not fit for prime time seeking 15sec of investor attention. Momentum Investors are geared towards sound bites and receive the bulk of air time.

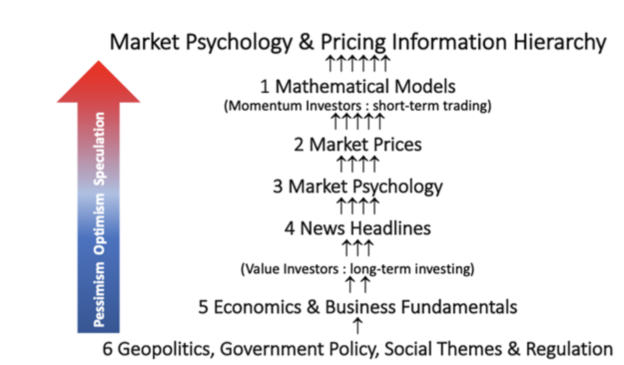

Momentum Investors state that market prices drive market psychology which in turn drives the economy. Value Investors state the reverse i.e,, economic activity and government policy drives financial reports that make the headlines with psychology and prices following in turn. . In the Market Psychology & Information Hierarchy illustration Momentum Investors, who think short-term (less than 12ms), focus only on levels 2-4 to create mathematical models. Value Investors think long-term (2yr-5yr) and begin at levels 5-6. For Value Investors price represents a premium or discount to the long-term returns across multiple markets. The lower the price, the greater the potential return. It is when Momentum Investors have so discounted the fundamentals key to Value Investors that the buying pressure from Value Investors causes enough of a price shift that Momentum Investors change from Bearish to Bullish. That shift began at the Oct 2022 low as Value Investors gained confidence and gradually pressured the SP500 issues to rise 20% triggering the media shift to calling this a “Bull Market” as if this was an overnight event.

The SP500 Net Non-commercial Futures Positions is a good measure of market psychology of Momentum Investors. One can take any portion of the historical record but the last 4 periods of widely-held market pessimism indicate that market hedging peaks at market lows. Hedging has a pattern of increasing even as the market rises, reaching a maximum months after the ‘horse has already left the barn’. This last bout of pessimism and hedging produced a record -434.2 2 wks ago recovering to a still very pessimistic -344.5 at the end of last week. Once the SP500 rose 20% from its October low, suddenly everyone is optimistic.

The weekly record:

Week SP500 declines to a Low Point Week Net Futures Low Point

Dec 21, 2018 March 1, 2019(2.5mos)

March 20, 2020 June 19, 2020(3mos)

June 16, 2022 Aug 19, 2022(2mos)

October 14, 2022 June 2, 2023(8mos)

It looks like the turn higher is in place. Employment, the most fundamental of indicators, during this entire period has remained in an uptrend. It is when Value Investors cause enough of a price rise that a “Bull Market” is announced. The reality is that many company details have indicated rising demand and they have been raising guidance for some time.