Category: Articles

S&P 500 Intrinsic Value Update

Be Wary When They Attack The Messenger

Bernstein on AIG

Housing Starts Accelerating Above Trend

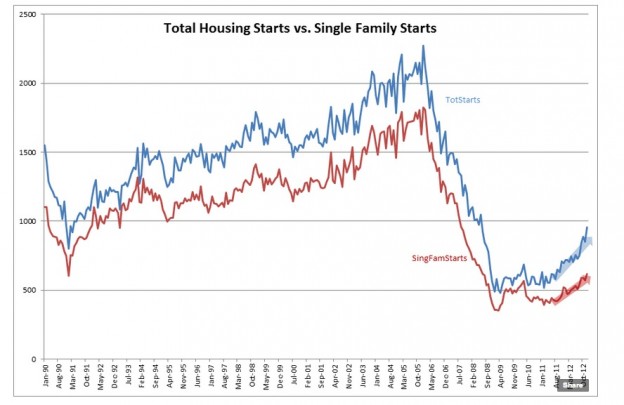

In spite of the Fiscal Cliff fears and now the many fears expressed in the upcoming US Debt negotiations, it appears that not only is there not a slowdown in home construction, but an acceleration. The Housing Starts report continues to confirm that a home building recovery is gaining momentum. See the chart below.

What this means to equities is that this long underperforming sector of our economy may finally be adding its clout to stock prices, i.e. stock prices are rising as the news improves. The net/net is that to build more housing one needs to hire more people which adds to the purchasing power of society. This has always been a positive for equities.

I remain optimistic and continue to urge investors to raise commitments to equity. We have had 4yrs of generous volatility supplied by Hedge Funds yet in the end it has been economic fundamentals which drive equity prices higher. A housing recovery/expansion is not an overnight process but requires several years to complete once it has begun. The signs are quite clear that beginnings occurred in mid-2011 and are likely to last for another 4yrs or so. The impact that housing and commercial construction combined have on our economy is quite dramatic. We lost ~ 50% of the employment from these sectors during the recession and one still needs the same number of individuals to build a house or commercial building today as we needed pre-recession. The recovery of these economic sectors in the US could add more than 10mill in payrolls. There will be a tremendous amount of pent up consumption added to our economy as these individuals become rehired.

I know that there will be someone somewhere with negative commentary, but for investors in common stock what is being reported is “sweet news”.

It appears the current pace of reported Starts is accelerating well above what appeared to be the previously reported trend.

A good housing/construction marketplace is also good news for financials. The financial troubles of individuals. Foreclosures and etc. tend to melt away when one goes from being out of work to earning a living wage with prospects of a brighter future. This completely changes everyone’s thinking and instead of looking for the next negative event people begin to anticipate positive outcomes.