Here are the top 5 sectors ranked by the percentage of the group reaching new highs

1- Retail- 25%

2- Chemicals / fertilizers- 17%

3- Internet-isp- 13%

4- Apparel-shoes- 12%

5- Electrical, military systems- 12%

Here are the top 5 sectors ranked by the percentage of the group reaching new highs

1- Retail- 25%

2- Chemicals / fertilizers- 17%

3- Internet-isp- 13%

4- Apparel-shoes- 12%

5- Electrical, military systems- 12%

McDonald’s (MCD)Chief Executive Officer Jim Skinner remarked, “May marks another month of strong sustained sales and shows how well we are providing solutions for today’s busy lifestyles, with the convenience and value that customers expect from McDonald’s. The chief reason given for the US business growth? Breakfast, or as I spell it c-o-f-f-e-e. Is Starbucks (SBUX) CEO Jim Donald paying attention now?

After their last earnings announcement, in an interview on CNBC, Donald said “we do not really consider or discuss our competition.” He’d better start. They are stealing his business. Attracting only 1% more people per quarter will not fuel the long-term growth rate of 21.9% that analysts expect.

When you compare Starbucks recent quarter with today’s statement by McDonald’s Skinner who said, “We’ve re-energized our worldwide business with new food choices, redesigned restaurants and relevant marketing. Around the world, demand for McDonald’s continues to grow as we now serve 6 million more customers every day than we did in 2002. We are working to attract more customers, more often, through innovation, added convenience and greater menu choices.”

This upcoming quarterly announcement by Starbucks will be very interesting. They are officially entering the “reduced comps” phase. This means that when they are comparing quarterly sales growth, the comparisons they are going up against now become easier as this quarter marks the beginning of the recent slide. It also coincides with the improved coffee offering at McDonald’s, but do not expect to hear that on the call.

While McDonalds is consistently blowing away improving numbers, Starbucks investors are hoping to beat diminishing ones. Not good. I am expecting bad news for investors this quarters and look forward to whatever excuse management comes up with. Last quarters anemic numbers were excused away as being “up against a tough comparison”. Now that the comparisons are getting dramatically easier, we need to take that one off the table.

Should be interesting..

The New York Court of Appeals on Thursday ruled tobacco companies who are part of the 1998 agreement that settled tobacco litigation with most states can go to arbitration to try to reduce their settlement payments. The $246 billion Master Settlement Agreement required tobacco companies to make annual payments to the states and also placed restrictions on how cigarettes are marketed but, if the tobacco companies that signed the agreement lose market share because of those restrictions, they are entitled to a refund of payments.

“It’s clearly spelled out in the Master Settlement Agreement that a dispute over a payment, which this is, should be resolved through binding arbitration,” said David Howard, a spokesman for R.J. Reynolds who has spearheaded tobacco’s fight for reimbursement. Altria had no comment.

Thursday’s ruling, which is in line with decisions by other state courts, means the tobacco companies can now try to reduce their 2003 payments through arbitration.

An auditor previously found in March 2004 that the companies who signed the settlement lost market share in 2003 and determined restrictions from the agreement were “a significant factor contributing to this loss”.

Among the companies that signed the master Settlement Agreement are Altria (MO) and Reynolds American (RAI) although neither was part of Thursday’s litigation.

One of two things will end up happening. Either the states will have to fork over hundreds of millions of dollars back to tobacco companies, monies that they just do not have or, the Master Settlement will be redone to both assure market share for it’s signers, and further insulate the industry from future litigation. The second is the most likely scenario as states are pitifully dependent on the tobacco monies and simple to not have the fiscal ability to part with it. Assuring market share gives growth back to the signers and a more ironclad agreement cements their stranglehold on the industry.

Altria is letting today’s plaintiffs, Commonwealth Brands, King Maker Marketing and Sherman and do it’s dirty work while it plays good corporate citizen by supporting the FDA’s potential regulation of cigarettes. The best part is? They are not only willing to do it but they are winning. Altria can rides their coat tails, avoid the legal expenses associated with it, and reap the rewards.

I simply cannot remember a time in which the litigation environment surrounding tobacco was this good.

Here is a great post that can be found at the blog The Mess That Greenspan Made. I take no credit for this, it is the authors in it’s entirety and it is very good.

The Post:

If you’ve been wondering why gasoline prices have been so high lately with crude oil trading at only $66 per barrel, the answer can be found at the refineries.

This week’s TWIP (This Week in Petroleum) from the Energy Information Administration has some interesting commentary and, as always, abundant charts to tell the story of how retail gasoline prices have fallen for the second consecutive week, down five cents to $3.16 per gallon.

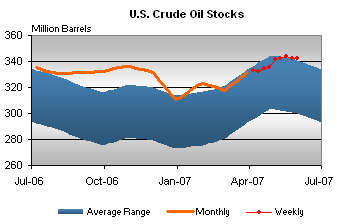

First, it should be clear that this is not an oil problem. U.S. oil inventories, the biggest raw material cost for gasoline (duh!) have been at or above the range considered normal for this time of year. There is no oil problem – that will occur sometime in the future, maybe soon, we’ll see.

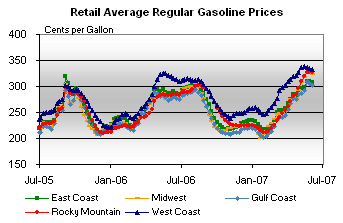

Yet, prices at the pump remain near record highs, particularly here on the West Coast where special formulation requirements and higher taxes almost always result in higher prices.

Yet, prices at the pump remain near record highs, particularly here on the West Coast where special formulation requirements and higher taxes almost always result in higher prices.

Lucky us – at least there’s no big brown cloud hanging over the Western U.S. (except sometimes in Phoenix) like the one hanging over parts of developing Asia .

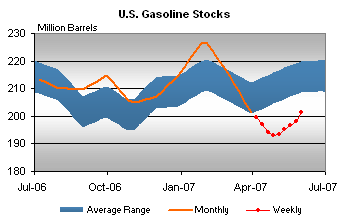

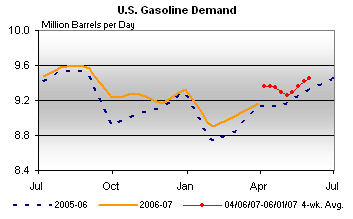

Gasoline stocks are way down, though they’ve been recovering dramatically in recent weeks as indicated by the current slope of the red-dotted line below. It turned ultra-steep last week in an attempt to make up for lost time and keep up with demand from the summer driving season that just started.

Have the refineries suddenly finished all their yearly maintenance work and flipped all the right switches to boost production?

Production has improved in recent weeks but it remains below levels from December of last year – refinery utilization for this time of the year is still below the levels of the last three years.

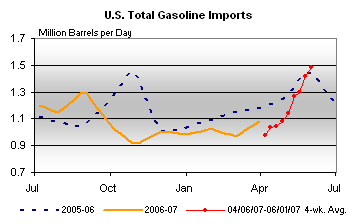

The downward price pressure (if you can call retail prices falling from $3.30 per gallon to $3.16 per gallon price pressure) comes largely from an increase in gasoline imports which have reached new multi-year highs.

And of course demand continues to increase, current levels of consumption for this time of year again at all time highs despite the higher prices.

And of course demand continues to increase, current levels of consumption for this time of year again at all time highs despite the higher prices.

Remember what a big deal it was a couple years ago when when gasoline stations couldn’t find enough number 3s to put up on their signs out at the curb?

With the precarious balance between the supply and demand for crude oil combined with aging refineries, it seems only a matter of time before there is a new crisis – finding enough number 4s.

Procter & Gamble (PG) was downgraded to equal-weight from overweight at Lehman Brothers, which said it will be “tough” for the Dow industrials component to deliver above-average returns. “As we see it, P&G’s business is healthy, but without much upside to fiscal 2008 margins versus our estimates nor likelihood of sustained re-acceleration in revenue growth,” the broker said. On Monday

I posted the very same sentiment is less esoteric terms. It is simple, huge discounts are a sign of slowing sales. If the discounting produces the sales, it does so at the expense of margins. Either scenario mean profits will come under pressure..

And yes that makes it “tough”, although I did not know it is usually “easy”

In what looks to be straight out of Dow (DOW)Chemical CEO Andrew Liveris’s playbook, John Rice, VP of the Archer Daniels Midland Company (ADM)said “Investment in research, infrastructure, and transportation, and partnerships between ethanol producer countries are the measures required in order to ensure the future of renewable fuels.” He said this at the panel Global Paradigms: The experience of ethanol in the United States and in Brazil, on June 4th at the Ethanol Summit 2007, São Paulo, Brazil.

The president of the São Paulo Sugar Cane Agroindustry Union (Unica), Eduardo Pereira de Carvalho, also believes a partnership between ethanol producer countries to be the best strategy for the success of renewable fuels. “Maize ethanol produced in the United States does not compete with our ethanol. My ‘enemy’ is gasoline,” Carvalho joked.

He continued, “What we need to do is make the forecast investment of US$ 17 billion in the production sector come true, qualify ethanol as an energy product in order to overcome barriers to agricultural products, and sign long term agreements,” he said.

ADM is currently the world’s largest producer of biodiesel and of corn ethanol and has stated it is looking for investment for ethanol in Brazil and will begin producing biodiesel there this month. This is exactly what Dow did recently in Saudi Arabia with it’s petrochemical announcement last month. If you are a producer a product, produce it where the input costs are the cheapest. Since the Brazilian ethanol program is quazi state run, also like Dow’s situation again, ADM will be going into business with the gov’t.

Brazil wants US investment in it’s ethanol program, ADM wants to produce cheap ethanol, this is going to happen….

You have probably heard the saying before that high tax rates cause people to engage in behavior that enables them to avoid paying those taxes. Some of it illegal, some legal. When you do business in the US, with our 40% average corporate tax rate being the world’s second highest, those efforts become pervasive. Take the recent case of IBM (IBM).

Why?:

It involves “Repatriation” of profits. The simplest way to describe that is foreign subsidiaries of US companies, if their earning are included in the results of the parent company, have profits taxed here is the US at US corporate tax rates in addition to taxes they may be paying in the country they are based.

To Avoid This:

IBM formed a new IBM subsidiary in the Netherlands. The unit spent $1 billion in cash and $11.5 billion in borrowed funds to buy 118.8 million shares — 8% of shares outstanding. They did this from a group of investment banks that had borrowed the shares from institutional investors. The investment banks will then return the borrowed shares with shares they buy on the open market over the next nine months. If its stock rises and the investment banks suffer losses, IBM will cover them.

The transaction was structured to let IBM buy back stock without repatriating retained earnings from its foreign units to the U.S.

IBM does not have cash hidden overseas. It plans to repay the loans to the banks used for the stock repurchase with future earnings from international subsidiaries in different countries. The estimated tax rate after various credits would be 22%. That would result in saving about $1.6 billion, compared to the taxes it would have incurred by repatriating the sums to the U.S. the person said.

Very sneaky, and until the IRS caught on and issued a notice on May 31st, very legal. Now let’s not get all upset at IBM. People behave in ways based on the conditions they find themselves in. Now, had we had the EU taxes rate of 26%, IBM may not have even investigated this. Were we in the US taxed at the 12.5% those companies in Ireland are, the topic would not have come up. When you tax folks the most, they will find ways around it. Management at IBM has a fiduciary responsibility to their shareholder and a move like this only show they take that seriously.

Rather than giving IBM a “tisk-tisk”, I am trying to find out if the multinationals in my portfolio have done the same thing and if not, ask, “who was sleeping in accounting?”

Borders Group (BGP) was downgraded to Sell from Neutral at Goldman Sachs. The firm believes a merger with Barnes & Noble (BKS) is less likely following the FTC’s decision to oppose the Whole Foods Market (WFMI) and Wild Oats Markets (OATS) deal. This kind of like comparing apples to, well, books.

In 2006, Amazon (AMZN) sold over $7 billion worth of books worldwide and a combined Borders / Barnes & Noble would sell about $8.5 billion. What is being overlooked here is the # of duplicate stores that would need to be closed, affecting total sales. This is not a 1+1=2 equation. This is more of a 1+1=1.5 equation.

What would be improved from the merger would be profitability, rather that size. Borders is currently going downhill fast and has not had a profitable quarter in over a year now. Cash flow, negative in 2004 and 2005 was positive in 2006 only because of $317 million in borrowing. Borders need to merge to survive, not create a powerhouse. With national bookstore sales declining and less than 10% of it’s books sold online (Borders jointly owns it’s site with Amazon), a Barnes & Noble-Borders combination is not going to challenge Amazon anytime soon, it just assures they survive.

In 2006 Borders lost $73 million (and looks to lose more in 2007) and Barnes & Noble had a $150 million profit. Those are not exactly monopoly fear inducing numbers when you compare it to the $460 to $590 million in profits Amazon projects. Of course not all of that is book, 70% of Amazon’s revenue is from books. Even a conservative estimate places it’s profit from books at over twice that of Barnes & Noble. Monopoly considerations are almost always due to consumer pricing concerns, Amazon dictates pricing to both Borders and Barnes and Noble, a combination of the two will alleviate cost pressures and enable the combined entity to better compete with Amazon on price and customers will benefit, thus the FTC would approve the merger with certain considerations. Heck, if they just wait long enough, Borders will probably go under and Barnes & Noble can just pick it up on the cheap.

Would there be divestitures? Sure. Would the combination be more profitable? That would be the point of doing it, right?

Would I be an investor in either now? Hell no. But not buying shares based on FTC concerns is misplaced.

Carol Levenson, an analyst with independent research firm Gimme Credit, wrote in a note to investors Tuesday that Sears Holdings (SHLD) could be a “dark horse” target, possibly so Ackman could lobby for a Sears Canada spinoff to boost shareholder value. This is foolish

Last week, analyst Sean Egan, managing director at Egan-Jones Ratings Co., raised the speculation that Lampert might buy the 58 percent of Sears Holdings Corp. he doesn’t already own and take it private, given its poor performance. Not foolish but unlikely. Let’s address these one at a time.

In the past Ackman has made a name for himself with high profile shareholder initiatives at McDonalds (MCD) and Wendy’s (WEN). An attempt to do battle with Lampert at Sears will be a disaster for him. Unlike McDonalds and Wendy’s, Lampert controls 65 million shares of Sears or over 40% of all shares and based on the recent 10Q filed June 1st, the number of outstanding shares is decreasing, increasing his ownership percentage. Nothing, I repeat nothing will be done at Sears that Lampert does not want done. You also have to consider the stocks rise from $23 to $180 in four years. Ackman will have a tough time convincing anyone he could do better and that getting rid of Sears Canada will benefit anyone but him (he owns I believe 12% of it). If anything, shareholders will tell him to take a hike, sell Lampert (who owns 70% of it) his stake and let Eddie do his thing with it. His battle with Lampert over Sears Canada (SCC.TO) was well documented and he has profited with it’s stock price rising 50% the past year as he refused to sell his stake. Now, refusing to sell your shares and convincing Lampert to spin off his are two entirely different things.

Ackman is no dummy and he surely realizes this.

Now, for the “taking private” argument. Possible but unlikely. If Lampert has any desires to become the “next Warren Buffett”, he cannot do that with a private company. What has made Buffett iconic is that mom, pop and the next door neighbor got rich with him, a private Sears Holdings eliminates that possibility. Will he purchase more shares for himself and have Sears purchase more to decrease to count and increase EPS? Yes and he is. Good

Alas this seem to be not much more than rampant Lampert speculation….

The Federal Trade Commission said it will block the company’s pending $565 million takeover of competitor Wild Oats Markets (OATS). The companies plan to challenge the FTC’s suit, which follows a request in March for additional information on the $18.50 per-share deal. The FTC claims the transaction will result in an unacceptable limitation on competition in the natural and organic food market. Are they kidding?

Whole Foods Chairman and CEO John Mackey replied, “The FTC has failed to recognize the robust competition in the supermarket industry, which has grown more intense as competitors increase their offerings of natural, organic and fresh products, renovate their stores and open stores with new banners and formats resembling Whole Foods Markets (WFMI) .” Here is a quick quiz, do you know who the largest seller of organic milk is in the US today? The answer is below.

Organic food sales totaled nearly $17 billion in 2006 (22% growth), representing 3% of total retail sales of food and beverages in the United States, the Organic Trade Association announced at the All Things Organic show, citing findings from their 2007 Manufacturer Survey. Conventional supermarkets accounted for approximately 31% of total organic food sales, while leading natural food supermarkets — such as Whole Foods, Wild Oats and Trader Joe’s — accounted for 24%. Independent natural food stores netted 22% of organic sales. Another 20% growth is forecast for 2007 putting total sales at over $20 billion this year. With just over $1 billion in sales Wild Oats is only 5% of the market. That is 5% of a sub-market, that is only 3% of the whole retail food market. Why is the FTC even bothering with this? I posted in the past that the merger was almost insignificant to Whole Foods future

.

With news that Walmart (WMT),the #1 grocer in the US plans to double organic food offerings, the merger being attempted is not to dominate an industry, but to keep pace. Consider Walmart is already the #1 seller of organic milk in the US and recently Karen Burke, a Walmart spokesperson said “Organic apples are one of the top selling organic produce items at Wal-Mart, along with carrots, citrus, lettuce and packaged salads. Far from “backing off,” sales for Wal-Mart’s organic produce for 2006 were at a growth rate well above the industry average of 13.7 percent, based on data from the Organic Trade Association.

The FTC’s decision, should it stand all but assures Walmart will also dominate here very soon.

“On average over the coming quarters we expect the economy to advance at a moderate pace close to or slightly below the economies trend rate of expansion” Ben Bernanke 6/5/2007. On this speech the market sold off .5% today or about 80 points on the Dow and 8 points on the S&P. I guess I am confused because, how is this anything different than anything he has been saying for the last 6 moths?

Regarding housing he added “We have not seen major spillovers from housing onto other sectors of the economy,” he observed.

As for inflation, he said that underlying inflation, which excludes food and energy prices, still remains “somewhat elevated” despite some improvements. Bernanke again clung to the Fed’s forecast that underlying inflation seems likely to moderate gradually over time. Again, has he ever said anything different? If anything, this inflation talk has seemed to moderate fro earlier statements.

In February in testimony to congress he said “In the five policy meetings since the July report, the Federal Open Market Committee (FOMC) has maintained the federal funds rate at 5-1/4 percent. So far, the incoming data have supported the view that the current stance of policy is likely to foster sustainable economic growth and a gradual ebbing of core inflation. However, in the statement accompanying last month’s policy decision, the FOMC again indicated that its predominant policy concern is the risk that inflation will fail to ease as expected and that it is prepared to take action to address inflation risks if developments warrant”.

Later in the testimony he said “Overall, the U.S. economy seems likely to expand at a moderate pace this year and next, with growth strengthening somewhat as the drag from housing diminishes. Such an outlook is reflected in the projections that the members of the Board of Governors and presidents of the Federal Reserve Banks made around the time of the FOMC meeting late last month. The central tendency of those forecasts–which are based on the information available at that time and on the assumption of appropriate monetary policy–is for real GDP to increase about 2-1/2 to 3 percent in 2007…”

So, what is the problem? Why are we so caught up in potential rate cuts when the guy has never even alluded to one? If anything, we should be relived he is not raising them to crush inflation. Also, when did 5.25% become a high rate?

If he drops rates that’s bad because that means growth is slowing or unemployment is on the rise. The status quo right now is working just fine, no need to tweak things just to tweak them.

Regarding the state of US business he said “The business sector remains in excellent financial condition, with strong growth in profits, liquid balance sheets, and corporate leverage near historical lows. Last year, those factors helped to support continued advances in business capital expenditures.”

Still trying to find the problem here. This market is a bit masochistic as it takes good news and punishes itself… odd.

The USDA released it’s Sweetener Outlook yesterday at 4pm and if you are an investor at ADM (ADM), The Andersons (ANDE), Corn Products (CPO) or other HFCS producers, the news was indeed good.

Expect profits from HFCs to continue to rise. The Renewable Energy Act was signed in November 2005. I will be looking at it’s effect on HFCS since them and take into account recent events in Mexico.

The Details

– Total deliveries of all corn sweeteners (HFCS & Dextrose) rose from 9,004,000 tonnes in 2005 to 9,084,000 tonnes in 2006.

– Percentage of total corn crop acreage dedicated to corn sweeteners dropped from 6.8% to 6%

– Total acres dedicated to corn sweeteners was flat at 758,000 acres

– Price of HFCS rose 32% from 11/2005 to 5/2007

Let’s take a visit down memory lane to Econ 101. When you have decreasing supply of a product and increasing demand, what has to happen to price? It goes up. That has been precisely what has happened to date. Now we need to gaze into our crystal ball.

Mexico

In July 2006 the US and Mexico settled a NAFTA dispute over sugar and HFCS. Under the agreement, Mecixo dropped an 20% tariff on all products made with US HFCS . From July to December 2007 US HFCS makers may export 500,000 tonnes of syrup to Mexico and in January of 2008, all restrictions are lifted. What does all this mean? First we need to look at HFCS demand in Mexico, since 2005, demand for the syrup has risen 112% to 750,000 tonnes a year. What has held back a further increase? Supply. With the new agreement that supply problem in now cured allowing this market to expand even faster.

When US producers export the 500,000 tonnes allotted this years that equates to an almost 6% decrease in available supplies in the US. Back to Econ 101, when you have stagnant levels of production inputs, decreasing supply of the finished product and constant or increasing demand you inevitably have? Increasing prices!

Expect more price increases for HFCS for the coming years and with the USDA projecting corn prices to begin a steady decline after 2008, HFCS production will become very profitable (I should say even more profitable that it is now). Now this also assumes no increase in the renewable fuels standard that I think we all know is coming which will further restrict corn available for HFCS production pushing prices higher. The also means investors in Coke (KO) and Pepsi (PEP) are looking at substantial cost increases without any real way to offset them.

More Good News?

The USDA also released the Crop Progress report yesterday and the corn progress (emerged) was at 94%, ahead of last years 93% and well ahead of the 2002-2006 average of 88%. What is important is that this is 94% of the largest corn crop since 1944. Even better news is that 78% of the crop is rated “good ” to “excellent”, well ahead of last years 71%.

All the economic and political factor are lining up perfectly for ethanol and HFCS producers. When you add the fact that many of these companies are currently selling at bargain valuations, the upside for shares is tremendous.

Expect corn prices to begin to fall as the record crop comes in and syrup and ethanol makers profits to expand further.

Portions of an interview between Jim Cramer and Aaron Task of “Wall Street Confidential” (a video feature on TheStreet.com) have been published in the June 2007 issue of Harper’s Magazine. Many folks will be furious at what Jim reveals, but I think from a pragmatic view, this is a wonderful learning lesson

“You’ve really got to control the market. You can’t let it life. When you get a Research in Motion (RIMM), it’s really important to use a lot of your firepower to knock that down, because it’s the fulcrum of the market today. You can’t create, yourself, an impression that a stock’s down. But you do it anyway, because the SEC doesn’t understand it… This is just blatantly illegal.

But when your company may be in doubt because you’re down, I think it’s really important to foment an impression that Research in Motion isn’t any good, because Research in Motion is the key today. When your company is in survival mode, it’s really important to get the people talking as if there’s something wrong with RIM. Then you would call the Journal and you would get the bozo reporter on Research in Motion. And you would feed him a rumor that Palm’s got a killer it’s going to give away. Theses are all the things you must do on a day like today, and if you’re not doing it, maybe you shouldn’t be in the game.

What’s important when you’re in hedge-fund mode is to not do anything remotely truthful, because the truth is so against your view that it’s important to create a new truth, to develop a fiction… The great thing about the stock market is that it has nothing to do with the actual stocks… It’s just fiction and fiction and fiction”.

He also mentions ways in which someone could affect Apple’s (AAPL) stock via iPhone rumors.

Now the moralists out there are seething. “This is pure manipulation!” They are screaming. Yeah, and the sun will rise today also. This stuff has and will happen for ever. The moralist out there will throw up their hands in disgust and walk away from the game, the pragmatist will profit from it. An unexplained drop in a stock is now explained, a run with no news now make sense. In the past where you may have hopefully panicked and sold, you now will hold on and eventually profit.

I have said many times before that I am not a fan of Jim’s bipolar trading style but I do think when he takes off the “tv persona” and calmly talks about the markets and their machinations, no one is better. You can call it bragging, honesty or manipulation if you want, but the guy has been at the center of the game and anytime anyone from there “spills the beans”, learn from it.

CNBC’s Jim Cramer was interviewed yesterday on his TheStreet.com video. He had a take on the iPhone that struck me as familiar.

Now, he was talking about the Apple (AAPL) trade before the release of the iPhone. I am going to skip the “trade” part of his talk because that is not what I do. As for his analysis, he specualted that Apple’s stock is priced for perfection of the phone meeting or esceeding the hype surrounding it and said that if the phone fails to meet the hype, the “stock gets crushed”. The chance of the iPhone exceeding expectations was only 20% which meant there was an 80% change the phone meets or fails to meet the hype, either of which will not benefit the stock at it’s current levels. He then speculated that people will not want to switch carriers to AT&T, which he claimed “is an inferior network” as easily and as fast as many people seem to beleive they will. He also said that many people have cell calling plans currently that “are not easily undone” and that will slow sales.

Now, where have we heard those arguments before?

One also has to take into account that in the NY Times reported yesterday “The anticipation, which is intense even by Jobsian standards, has led to some quiet, behind-the-scenes anxiety at Apple. Some Apple executives worry privately that expectations for the one-button phones may be too high and that first-generation buyers will end up disappointed.”

I said before that Apple shares are “priced for perfection” and it would seem at least seem that Jim Cramer agrees.

The USDA released it’s Sweetener Outlook yesterday at 4pm and if you are an investor at ADM (ADM), The Andersons (ANDE), Corn Products (CPO) or other HFCS producers, the news was indeed good.

Expect profits from HFCs to continue to rise. The Renewable Energy Act was signed in November 2005. I will be looking at it’s effect on HFCS since them and take into account recent events in Mexico.

The Details

– Total deliveries of all corn sweeteners (HFCS & Dextrose) rose from 9,004,000 tonnes in 2005 to 9,084,000 tonnes in 2006.

– Percentage of total corn crop acreage dedicated to corn sweeteners dropped from 6.8% to 6%

– Total acres dedicated to corn sweeteners was flat at 758,000 acres

– Price of HFCS rose 32% from 11/2005 to 5/2007

Let’s take a visit down memory lane to Econ 101. When you have decreasing supply and increasing demand, what has to happen to price? It goes up. That has been precisely what has happened to date. Now we need to gaze into our crystal ball.

Mexico

In July 2006 the US and Mexico settled a NAFTA dispute over sugar and HFCS. Under the agreement, Mecixo dropped an 20% tariff on all products made with US HFCS . From July to December 2007 US HFCS makers may export 500,000 tonnes of syrup to Mexico and in January of 2008, all restrictions are lifted. What does all this mean? First we need to look at HFCS demand in Mexico, since 2005, demand for the syrup has risen 112% to 750,000 tonnes a year. What has held back a further increase? Supply. With the new agreement that supply problem in now cured allowing this market to expand even faster.

When US producers export the 500,000 tonnes allotted this years that equates to an almost 6% decrease in supplies in the US. Econ 101, when you have stagnant production inputs, decreasing supply and constant or increasing demand you have? Increasing prices!

Expect more price increasing for HFCS for the coming years and with the USDA projecting corn prices to begin a steady decline after 2008, HFCS production will become very profitable. Now this also assume no increase in the renewable fuels standard that I think we all know is coming which will further restrict corn available for HFCS production pushing prices higher.

More Good News?

The USDA also release the Crop Progress report yesterday and the corn progress (emerged) was at 94%, ahead of last years 93% and well ahead of the 2002-2006 average of 88%. What is important is that this is 94% of the largest corn crop since 1944. Even better news is that 78% of the crop is rated “good ” to “excellent”, well ahead of last years 71%.

All the economic and political factor are lining up perfectly for ethanol and HFCS producers. When you add the fact that many of these companies are currently selling at bargain valuations, the upside for shares is tremendous.

Expect corn prices to begin to fall as the record crop comes in and syrup and ethanol makers profits to expand further.