Berkshire Hathaway 1971 Shareholder Letter

Disclosure (“none” means no position):

Visit the ValuePlays Bookstore for Great Investing Books

Berkshire Hathaway 1971 Shareholder Letter

Disclosure (“none” means no position):

Visit the ValuePlays Bookstore for Great Investing Books

Ken Chace 1969 Letter to Berkshire Shareholders

Disclosure (“none” means no position):

Visit the ValuePlays Bookstore for Great Investing Books

There is a growing chorus that feels the current situation will be resolved with a “V” recovery in which upside is a violent as the downside has been. To wit:

Here is the theory:

“Davidson” submits:

Wesbury has had this stance for some time. One way I would explain this is that this was not a consumer lead economic slow down. Consumers were actually still in good shape re: credit scores and could have continued to buy cars and houses if the lending institutions were lending. BUT, the lending institutions stopped lending and consumer sales hit a wall. Consumers do not stop dead this way, especially after nearly 3yrs of slow down that began at the beginning of 2006 in housing and autos. This whole slow down is an institutional/governmental heart attack on top of a normal slow down that began with the effect of Mark-to-Market on Lehman, AIG, Bear Stearns and then was kicked over the cliff with SEC Cox’ ban on short selling.

This has been such a misunderstood economic panic that was caused by first cheap money, then encouraged by political avarice, fostered by poor regulation and the incredibly stupid belief in the “Free Markets Self Correct” syndrome and then topped off by incredibly inane elimination of the “Up-Tick Rule”, the passive approach to naked short selling, the political decision to let Lehman fail so that Republicans could display some “Character?” during the Presidential election and the rest is history. The consumer was in fact OK till the credit markets and importantly the Money Markets seized with now bankrupt Lehman commercial paper.

Politicians and regulators just do not see that it is they who are the problem, it is they who have failed to act in accordance with the regulations that they passed. Politicians and regulators are looking for some one else to blame because they are so thick in the middle of causing this mess that I really don’t think they even have a clue as to what they have done. And they think that they are the solution to the problem??

The market is healing on its own. That this is occurring you can see from the rise in Treasury rates as funds flow into various market channels looking for opportunity. I watch with fascination the activities of Warren Buffett and numerous savvy investors buying up discounted assets especially real estate. The signs are there for all to see.

I am all in and have been since January ’09.

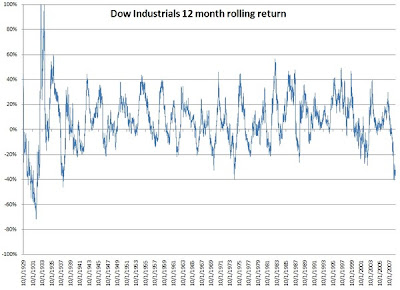

Could it be? Consider the following chart from Howard Lindzon

It shows, far from being an abnormality, “V” recoveries in equity markets are the norm. Now, the question we need to answer is “Are we at the bottom of the “V” or are we going down to a point between where we are now and the bottom of the 1931 “V”?”

The optimists will say we are at the bottom while the pessimist will say we will pass 1931. I lay not in either camp. My take is that we fall further then shoot up. How much further, who knows, and anyone who tells you they do is lying, they are guessing. My take is that based on the news flow and economics trends, which are still negative in the aggregate, more downside is in store. I know recent numbers have been encouraging but a month does not a trend make (nor does two).

In that vein, Henry Blodget writes:

Prof Shiller’s work (above chart) shows clearly that stock values are mean-reverting. The only trouble is the time they take to mean-revert. If things go badly over the next few years, stocks could bounce along the bottom for another decade or more.

For example, Jeremy Grantham, whose shop (GMO) produced the forecasts above, reminds us what happened in the 1970s:

“Today all equities are moderately – one might say, boringly – cheap. The forecast for the S&P has been jumping around +6% to +7% real, with other global equities slightly higher.

To put that in perspective, a 1-year forecast done on the same basis we use today that started in December 1974 would have predicted a 14% return (which, by the way, it did not deliver since the market stayed so cheap). For August 1982, the forecast would have been shockingly high – over 20% real! So do not think for a second that this is as low as markets can get. “

(It’s worth noting, though, that 1982 was the start of the great bull market. Jeremy also warns of the possibility of another sucker’s rally, so don’t get too comfortable waiting for the bottom:

“Now, I admit that Greenspan and 9/11 tax cuts caused the “greatest sucker rally in history” from 2002-07. We therefore cannot rule out another aberrant phase in which extreme stimulus causes the market to rally once again to an overpriced level for a few more years, thus postponing the opportunity to make excellent long-term investments yet again. But I think it’s unlikely. “

One thing seems certain: Stocks are cheaper now than they have been at any time in the past two decades. That’s encouraging for those with another couple of decades to invest and–increasingly rare these days–cash to put to work.

We’ll see….I think we have a bit deeper on the “V” to go..

Disclosure (“none” means no position):

Visit the ValuePlays Bookstore for Great Investing Books

After a a year of saying Berkshire Hathaway (BRK.A) was no value, I’m thinking it just may be getting there.

In July 2008 I said:

Wholly-owned subs such as Shaw Industries, Clayton Homes, Jordan’s Furniture (the are 4 furniture companies), Benjamin Moore, Home Services and Acme Brick and directly tied to housing and will suffer in the downturn.

For all its holdings, Berkshire is essentially an insurance company. It has operated under “perfect” conditions for the last two years according to Buffett and eventually to run must end. Premiums are already falling and as houses are re-poed and fewer new cars are purchase, insurance premiums derived from those products will fall accordingly. I know people who are looking at homeowners and auto policies for way to decrease coverage and save money. Whether or not this is a good idea is irrelevant (I do not think it is), it is happening. Throw in a hurricane or two (we are due) and insurance could suffer quite a poor year.

For more on Berkshire’s insurance read this former post:

Back in March when shares sat at $133,000 I argued they were not a “value”. Today they sit at $111,000. Are they a value now? Perhaps but one also has to expect that the near term, if Tilson is correct is fraught with potholes for Berkshire and earnings ought to take a hit.

Based on that, share price ought to suffer also meaning you will probably be able to pick them up cheaper down the road. If I owned shares would I sell? If I needed the money in the next year, yes. If I had a multi-year time frame would I sell? No. If that was the case I would be watching down the road for a cheaper entry price, I think you’ll get it.

What has happened since then?

Berkshire agreed to purchase $150 million of 10 1/8% notes due in 2015 and $250 million of 10 3/8% notes due in 2018 from Birmingham, Ala.-based Vulcan. The note sale was reported in late January, but Vulcan didn’t identify the buyer of the notes until Tuesday’s earnings conference call.

Other recent Berkshire bond purchases include $300 million of Harley Davidson Inc. (HOG) 15% notes due in 2014 and $150 million of Sealed Air 12% notes due in 2014.

These purchases follow big transactions in the fourth quarter, when Berkshire purchased $5 billion of 10% preferred stock from Goldman Sachs (GS) and $3 billion of 10% preferred from General Electric (GE). Both those deals came with a sizable amount of equity warrants. During October, Berkshire also bought $4.4 billion of 11.45% subordinated notes and $2.1 billion of 5% preferred stock issued by Wrigley, which was purchased by Mars in a leveraged buyout.

One deal that Buffett probably regrets is his agreement to purchase $3 billion of convertible preferred stock in Dow Chemical Co. (DOW) if it goes forward with its deal to buy chemical maker Rohm & Haas Co. (ROH) for $15 billion. Berkshire’s purchase is contingent on the consummation of the deal.

Buffett may be hoping that the deal dies, or that Dow comes back to Berkshire with more generous terms to get a larger investment from Berkshire if Dow goes forward with the deal. Dow is resisting completion of the transaction, arguing that the debt that it would have to take on would be ruinous financially. As it stands, the Dow convertible preferred that Berkshire agreed to purchase will carry an 8.5% interest rate and a conversion price around $40, way above Dow’s current share price of $10.

If we do some simple math, Bekshire has put roughly $17.9 billion to work at 10%. That will provide Berkshire $1.7 billion a year for the next three years (some of it may convert to equity at that point). When one considers Berkshire has earned $7.8 billion of the last 12 months (Q4 2008 numbers not released yet), Buffett’s recent moved will add 21% to those earnings.

Now, insurance. Yes as stated above, the party is over but, rates are scheduled for increases. As insurance companies look to cover losses in investment portfolio’s, the aggressive pricing that has taken place in the past few years will abate, causing industry rates to rise. Also, one should expect those insurance companies feeling the pinch to take fewer larger risks. Since this is an area Berkshire loves to play in, fewer players will mean stronger pricing power on the part of Berkshire.

We will not a resurgence to the “glory years” in insurance, but conditions for the first time in a few years will improve. Remember, Berkshire is essentially an insurance company, since that business seems to have stabilized, being the best of that lot, we must assume Berkhsire has.

Berkshire’s investment portfolio has been hurt this year by the weak showing of some of its major equity investments, Wells Fargo (WFC), U.S. Bancorp (USB), Kraft (KFT), Coca-Cola (K) and Procter & Gamble (PG). While prices here are depressed, there is no permanent impairment to earnings and that is a point being missed by folks. To believe these companies will be at depressed prices 3 years from now means the global economy will not recover. If you believe that, buying any equity is a waste of time.

Berkshire is big holder of those three companies’ shares and it also is short $37 billion of long-dated put options on the S&P 500 and other equity indexes. As the market has dropped, Berkshire has taken a charge to earnings (no cash) in the write-down of the value of these options. When the market rises, the opposite will happen (write-up). Again, to assume no improvement here implies US business is stagnant for the next decade.

Now, Berkshire is down roughly 33% since my fist post on it. The difference now is that several of its businesses are showing signs of life and Buffett has put billions to work at 10% vs the pittance is was getting previously in Treasuries.

The next piece of the puzzle is the Berkshire manufacturing businesses listed above. They will turn when the economy does. If you believe that is the 2nd half of this year, the time to buy is now. If you believe that is 2010, you have time to wait.

Will Berkshire go lower? I do not know but I do know that there isn’t a good reason for it to go much lower barring further dramatic worldwide economic collapse.

Time will tell but I think Berkhsire at its current levels do not have much more downside….

Disclosure (“none” means no position):Long WFC, none

Visit the ValuePlays Bookstore for Great Investing Books

Berkshire Hathaway (BRK.A) and Buffett hold 8.6% of the common in Goldman Sachs (GS)

“Explanatory Note: The Reporting Persons had intended to file this Schedule 13G pursuant to Rule 13d-1(b), pursuant to which it would have been timely filed on February 17, 2009. In the course of preparing this Schedule 13G, the Reporting Persons determined that BH Finance, LLC, which is not an entity specified in §240.13d-1(b)(1)(ii)(A) through (J), owns slightly more than 1% of the Issuer’s outstanding common stock, making the Reporting Persons ineligible for Rule 13d-1(b). All shares of Common Stock of The Goldman Sachs Group, Inc. reported in this Schedule 13G are held in the form of warrants exercisable by the Reporting Persons within 60 days.”

Disclosure (“none” means no position):None

Visit the ValuePlays Bookstore for Great Investing Books

Berkshire Hathaway (BRK.A) now has 34% of USG (USG)

From the filing

BH Nebraska is the holder of $160 million aggregate principal amount of the Notes (the “BH Nebraska Notes”), which, to the knowledge of the Reporting Persons, if converted, would constitute approximately 11.2% of USG’s outstanding Common Stock, based on the number of shares of Common Stock disclosed as outstanding on the Issuer’s Form 10-Q filed with the Commission on October 28, 2008. BH Assurance is the holder of $90 million aggregate principal amount of the Notes, which, to the knowledge of the Reporting Persons, if converted, would constitute approximately 6.3% of USG’s outstanding Common Stock (the “BH Assurance Notes,” and together with the BH Nebraska Notes, the “Nebraska/Assurance Notes”), based on the number of shares of Common Stock disclosed as outstanding on the Issuer’s Form 10-Q filed with the Commission on October 28, 2008. General Re Life is the holder of $50 million aggregate principal amount of the Notes, which, to the knowledge of the Reporting Persons, if converted, would constitute approximately 3.5% of USG’s outstanding Common Stock (the “General Re Life Notes”), based on the number of shares of Common Stock disclosed as outstanding on the Issuer’s Form 10-Q filed with the Commission on October 28, 2008. Mr. Buffett may be deemed to control Berkshire, which controls BH Nebraska, BH Assurance and General Re Life. Thus, both Mr. Buffett and Berkshire may be considered to have beneficial ownership of the Nebraska/Assurance Notes and the Gen Re Life Notes. NICO, an indirect subsidiary of Berkshire and the direct parent company of BH Nebraska and BH Assurance, also may be considered to have beneficial ownership of the Nebraska/Assurance Notes. OBH, a direct subsidiary of Berkshire and the direct parent company of NICO, also may be considered to have beneficial ownership of the Nebraska/Assurance Notes. Cologne Re, an indirect subsidiary of Berkshire and the direct parent company of General Re Life, also may be considered to have beneficial ownership of the General Re Life Notes. General Reinsurance, an indirect subsidiary of Berkshire and the direct parent company of Cologne Re, also may be considered to have beneficial ownership of the General Re Life Notes. General Re, a direct subsidiary of Berkshire and the direct parent company of General Reinsurance, also may be considered to have beneficial ownership of the General Re Life Notes.

(b) BH Nebraska has voting and investment power with respect to the BH Nebraska Notes. BH Assurance has voting and investment power with respect to the BH Assurance Notes. However, Mr. Buffett, Chairman of the Board of Directors of Berkshire, who may be deemed to control BH Nebraska and BH Assurance, directs the investment of BH Nebraska and BH Assurance. Thus, Mr. Buffett, Berkshire, NICO and OBH share voting and investment power with respect to the Nebraska/Assurance Notes. General Re Life has voting and investment power with respect to the General Re Life Notes. However, Mr. Buffett, Chairman of the Board of Directors of Berkshire, who may be deemed to control General Re Life, directs the investment of General Re Life. Thus, Mr. Buffett, Berkshire, Cologne Re, General Reinsurance and General Re share voting and investment power with respect to the General Re Life Notes.

Item 6 is hereby amended to add the following:

On November 21, 2008, Berkshire and USG entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”), pursuant to which, and subject to the terms and conditions thereof, Berkshire agreed to purchase Notes in an aggregate principal amount of $300 million, and USG agreed to sell Notes in an aggregate principal amount of $300 million dollars, for an aggregate purchase price of $300 million. On November 26, 2008, BH Nebraska purchased $160 million aggregate principal amount of the Notes, BH Assurance purchased $90 million aggregate principal amount of the Notes, and General Re Life purchased $50 million aggregate principal amount of the

Notes.

Following stockholder approval of the issuance of shares of Common Stock upon conversion of the Notes at a special meeting of the USG stockholders held on February 9, 2009, the Notes became convertible into Common Stock at the option of BH Nebraska, BH Assurance and General Re Life at any time prior to the close of business on the business day immediately preceding the final maturity date of the Notes (December 1, 2018), unless the Notes are earlier repurchased or redeemed by USG, subject to the terms and conditions set forth in the indenture and the supplemental indenture governing the Notes (the “Indenture”). The Notes are convertible into Common Stock at an initial conversion price of $11.40 per share, subject to adjustments as set forth in the Indenture.

On November 26, 2008, Berkshire and USG entered into an Amended and Restated Registration Rights Agreement (“Registration Rights Agreement”), pursuant to which USG has granted BH Nebraska, BH Assurance and General Re Life certain registration rights with respect to its shares of Common Stock and the Notes. The Registration Rights Agreement amended and restated in its entirety that certain Registration Rights Agreement, dated as of January 30, 2006, between USG and Berkshire.

The preceding discussion of the Securities Purchase Agreement, Assignment and Assumption Agreement, Indenture and Registration Rights Agreement does not contain a complete description of such agreements and is qualified in its entirety by reference to such agreements, which are filed as exhibits hereto and incorporated herein by reference.

Here are the details of the convertible transaction

Disclosure (“none” means no position):None

Visit the ValuePlays Bookstore for Great Investing Books

Seeing the Blankfein piece in the FT against Mark-to-Market vs. Wesbury is the dichotomy of the market place. Those who believe in Efficient Market Hypothesis believe that price trend represent all the information available for a particular security. Mark-to-Market is valid in all environments for traders, technical and momentum investors. Efficient Market players have investment horizons from minutes to months. If they hold longer than a year, it is only due to a series of short term technical signals that reinforced holding.

The “Value Investors” on the other hand look for mispricing vs. fundamentals, i.e. discount to Book Value, Cash Flow or some other value parameter that is measurable and quantifiable. Warren Buffett is the prime example of Value Investing, the best known, but there are numerous others. However, the number of true “Value Investors” is far less than all other investors. Value investors investigate, analyze and parse a target company’s business till they are comfortable with the decision to commit funds at a level at which they feel an anticipated rate of return is likely to be had over a multi year period. It is not unknown for Value investors to hire investigators and analysts to look at each business site of a company’s operation, individual tax filings, competitors and vendor information in an effort to sleuth the locations of all values within a company. Value investors have an investment horizon that is typically greater than 5yrs.

Mark-to-Market accounting during down markets provides opportunities for Value investors. Their records are well known. There are no traders famous for their investment judgment over the same period of any well known value player.

Importantly, mixing Value investors and Efficient Market players (calling them investors is an abomination of the word) in the same room is like watching two vastly different cultures trying to communicate. They can’t. They are so culturally different that the terms, “value”, “return”, “analysis” which stand for defining action and criteria for one have no equal meaning in the other. What is even more bazaar is that in most instances they do not understand why they don’t understand each other as they each believe they are perfectly correct in their views of assessing investment opportunities.

I am a Value investor. There are truly very few of us vs. other investors. My guess is less than 2%.

Mark-to-Market accounting is an abomination of reasoning during periods of market disruption such as we just experienced when the SEC banned short selling. Unfortunately, there are more of them than us, but fortunately the market will and is currently righting itself even with the mistakes we have made and continue to make. Philosophically we need the majority of investors to not get it right so that us few can take advantage of the deep discounts not produced in any other way.

All will be well even if the current stimulus package is passed. It may just take longer.

Disclosure (“none” means no position):

Visit the ValuePlays Bookstore for Great Investing Books

This is about as transparent as it gets…But, it could lead to something..

The Kuwait Investment Authority would consider increasing its support for Dow Chemical’s (DOW) disputed takeover of Rohm and Haas (ROH) if the terms of the deal were changed to account for the downturn, a person familiar with the matter says.

Dow failed to complete the $15bn (€11.5bn) deal after the collapse of a joint venture between Dow and PIC – an arm of the Kuwaiti Petroleum Corporation – that was supposed to contribute $7.5bn to help pay for the acquisition. Warren Buffett has agreed to contribute $3bn and the KIA was to have added $1bn. According to a person with direct knowledge of the matter, the KIA would consider putting up more money if there were new terms.

“Today, it is very difficult to complete this deal on the old terms,” this person added. “There would have to be a new price and new terms. The environment has changed so much and chemical companies are losing so much money.”

Rohm and Haas underlined the brutal conditions faced by the sector, reporting an 81 per cent fall in fourth quarter earnings from continuing operations.

The figures make it harder for Dow to justify paying its original price for the company. Rohm shares fell more than 1 per cent to $55.70 at midday in New York, well below the $78 per share Dow agreed to pay last year.

The KIA had not approached Dow to discuss increasing its investment in the deal, Dow said. It is also highly unlikely that KIA on its own would put in anything like the $7bn to $8bn Dow would need to close the Rohm deal.

However, an increased investment by the KIA strikes many analysts as an elegant solution to the break-up of the Dow-PIC joint venture.

“There is a concern as to Kuwait’s reputation for direct foreign investment,” says Ahmed Barakat, managing partner with Al-Sarraf & Al-Ruwayeh in Kuwait City who is not directly involved in the matter. “KIA could salvage that reputation.”

Initial talks between the Kuwaitis and Dow began in 2007. In November 2008, the deal was renegotiated to reduce the Kuwaiti contribution to $7.5bn from $9bn in recognition of the deterioration in the economy.

Even the revised terms, however, met with criticism in the Kuwaiti parliament, where questions were raised about the price tag and a $2.5bn break-up fee.

Dow has until July to take advantage of its one-year bridge loan for the deal. It reported a $1.55bn fourth quarter loss.

What do we really have? Kuwait has finally realized the obvious to everyone else. They have done irreparable harm to their reputation as a business partner. At all cost, they want to avoid the coming legal confrontation with Dow. Why? Discovery will lead to disclosure on internal communication with Dow and their deception will be laid bare for the world to see.

Recent accusation from Kuwait of bribery from Dow officials and “reviewing” other upcoming ventures only served to further cast doubt on the country as a business partner in the international community.

This “offer to help” is an olive branch to Dow. What will happen is Kuwait will commit more funding for the Rohm deal and in return, Dow will drop its seeking $2.5 billion in damages. Despite what Kuwait has done, they are still a valuable partner for Dow although Kuwait must now see that Dow does have options as it has been confirmed they are talking to Sabic (Saudi Basic Industies) to purchase to commodity businesses Kuwait had been scheduled to buy. One must come to the conclusion the Kuwaiti’s thought they were the only dance partner Dow had.

Dow dropping the lawsuit lets Kuwait off the hook and clears the way for future collaborations, a positive for both parties.

Like I have said all along, this will all get worked out…in due time…

Disclosure (“none” means no position):Long DOW. none

Visit the ValuePlays Bookstore for Great Investing Books

So, there is a chart and a story going around regarding Berkshire’s (BRK.A) Warren Buffett that just does not jive to me. Hat Tip to “Davidson” for pointing bringing it to my attention..

First, here is the chart:

Here is the story that follows:

Fortune Magazine) — Is it time to buy U.S. stocks?

According to both this 85-year chart and famed investor Warren Buffett, it just might be. The point of the chart is that there should be a rational relationship between the total market value of U.S. stocks and the output of the U.S. economy – its GNP.

Fortune first ran a version of this chart in late 2001 (see “Warren Buffett on the stock market“). Stocks had by that time retreated sharply from the manic levels of the Internet bubble. But they were still very high, with stock values at 133% of GNP. That level certainly did not suggest to Buffett that it was time to buy stocks.

But he visualized a moment when purchases might make sense, saying, “If the percentage relationship falls to the 70% to 80% area, buying stocks is likely to work very well for you.”

Well, that’s where stocks were in late January, when the ratio was 75%. Nothing about that reversion to sanity surprises Buffett, who told Fortune that the shift in the ratio reminds him of investor Ben Graham’s statement about the stock market: “In the short run it’s a voting machine, but in the long run it’s a weighing machine.”

Not just liking the chart’s message in theory, Buffett also put himself on record in an Oct. 17 New York Times op-ed piece, saying that he was personally buying U.S. stocks after a long period of owning nothing (outside of Berkshire Hathaway (BRKB) stock) but U.S. government bonds.

He said that if prices kept falling, he expected to soon have 100% of his net worth in U.S. equities. Prices did keep falling – the Dow Jones industrials have dropped by about 10% since Oct. 17 – so presumably Buffett kept buying. Alas for all curious investors, he isn’t saying what he bought.

To examine this we need to go back the beginning.

One must remember that in the late 1960 Buffett closed the “Buffett Partnership” because at that time he felt “there were no values” in the general stock market. Yet, according to both the chart above and the story, Buffett would have been buying at this time.

If we fast forward to the mid 1970’s, a time when Buffett said he felt like “a guy in a whorehouse with a suitcase of cash” because stocks we so cheap, we see the above charts value level was actually below 50%. In fact, most of the largest positions in Berkshire’s portfolio, American Express (AXP), Coke (K), Gillette now PG (PG) and The Washington Post (WPO) were accumulted during this time. In fact, Buffett’s buying continued through the 1980’s and until the mid 1990’s when he then found equity values were overpriced, refrained from buying during the tech bubble and was called “out of touch” (he was later proven very right).

Again, looking at the chart we see during that at this time frame the chart values had crept back to the 75% level of the mid 1960’s when Buffett was a seller.

What is inmportant to note and what has been lost in the “Buffett is buying rhetoric” is that Warren’s three largest recent investments, totaling roughly $10 billion, Dow Chemical (DOW), GE (GE) and Goldman Sachs (GS) were NOT stocks purchases, they were preferred investments.

Essentially Buffett is betting their share prices will all rise, in the next 3 to 5 years, when the convertibles convert to common stock. Until then, he has a bond paying 10%. With Treasuries paying essentially nothing, Buffett has found a vehicle that pays 10% to park his cash.

Did Buffett pen the link article above? Yes. To be sure Warren is buying an interest in US companies as witnessed above, just not their common stocks (except Burlington Northern (BNI)).

Buffett’s preferred purchases are not an endorsement of cheap US equities, if anything it says he would rather be a bondholder than an equity one……for now.

Disclosure (“none” means no position):Long Dow, GE, none

Visit the ValuePlays Bookstore for Great Investing Books

Tom Russo, an excellent Buffett Style investor and a hell of a nice guy talks about last year..

Disclosure (“none” means no position):

Visit the ValuePlays Bookstore for Great Investing Books

Am the only one who thinks Paulson just wants his cash? Now, I do not blame him nor do I think he is being “greedy” but let’s not walk through the door under the “I’m here to help” auspice when we all know why you are there.

First the letter:

Dear Mr. Liveris,

Paulson & Co. Inc. on behalf of funds we manage is Rohm & Haas’ second largest shareholder, currently owning 18.9 million shares. We strongly urge you to close the transaction with Rohm & Haas. Financing is available to you through the committed $13 billion bridge loan and the $4 billion convertible preferred stock financing. Subsequently, if you have concerns about retiring the bridge financing, we suggest that Dow pay it off through a combination of (i) cutting its dividend, (ii) raising common equity and (iii) selling bonds.

While we understand that this is a difficult environment for the chemical industry, current conditions do not have any effect on your obligation to purchase Rohm & Haas. We don’t believe that by intentionally refusing to close the transaction that you are benefiting your shareholders. As you know, Dow’s obligation to complete the merger is not conditioned on financing and Dow is required to take all action necessary to obtain financing. Dow currently has financing in place to complete the acquisition and the combined Dow Rohm & Haas will have numerous alternatives to refinance the bridge loan.

Several times we have made suggestions to senior executives at Dow. First, we suggest that Dow can temporarily reduce its dividend to one cent per share. By doing so, Dow would save around $1.6 billion per year. In just 4 1/2 years, the annual $1.6 billion of cash will effectively replace the $7 billion of net proceeds that Dow was to raise from the unresolved Kuwaiti joint venture.

Second, we suggest that Dow can sell, post closing, $4 billion of new common equity. Many companies, both in the U.S. and abroad, are raising common equity to strengthen their balance sheets and include Anheuser Busch InBev ($9.8 billion) and Xstrata (~$5.9 billion). In this regard, in our conversations with Dow, we indicated that depending on the terms we would seriously consider participating in any equity offering you may make.

Third, we suggest that Dow can further reduce the bank financing by issuing bonds. Currently, there is strong market demand for investment grade debt. In January alone, $100 billion was raised, the most ever in a single month. By cutting the dividend and raising common equity, Dow should be able to maintain its investment grade rating and access the credit markets. We suggest that Dow can raise $5 billion in this market.

By cutting the dividend, raising common equity and selling bonds, Dow could repay the bridge financing by $10 billion, easily facilitating the financing for the acquisition. If desired, Dow can also subsequently issue more common stock or hybrid securities such as convertible preferred and convertible debt to completely repay the bridge facility. In short, a combined Dow Rohm & Haas would have numerous opportunities to refinance all or part of the bridge loan in the equity, bond, term bank loan or hybrid security markets. Of course these refinancing alternatives would be in addition to any proceeds you may receive from the aborted Kuwaiti transaction or other joint venture or asset sales you may pursue.

Of particular note in this regard is InBev’s acquisition of Budweiser which closed in 2008 in the midst of the credit crisis. Rather than complain about the status of the market, InBev drew down the bank financing and closed two business days after receiving antitrust clearance on November 18. Shortly thereafter, on December 16, Anheuser Busch InBev raised $9.8 billion in an equity offering (equivalent to 160% of its shares outstanding) and completely repaid the bridge financing. Furthermore, in January 2009 Anheuser Busch InBev sold approximately $7.5 billion in two debt offerings to repay short term indebtedness.

Interestingly, although Anheuser Busch InBev shares initially declined to a low of euro 10.31 on November 24, 2008, as a result of the repayment of the bridge loan with the equity and debt financings, the stock has risen 93% from its November low to close at euro 19.91 on January 30, 2009.

We suggest that Dow can follow the same strategy as InBev and close and refinance the Rohm & Haas acquisition. As we previously indicated, depending on the terms we would have a high interest in participating in any equity or hybrid security offerings. We also suggest that the Board act quickly in closing the transaction as you risk further damage to your shareholders by unnecessarily delaying the closing.

Let’s just look at it.

Cut the dividend to “pay of bridge loan in 4.5 years” Really? 4.5 years? Paulson does realize that the bridge loan is a ONE YEAR FACILITY, right? I am going to go out on a limb and say that the banks will not accepts “we’ll pay the rest in 3.5 year”….is it just me?

There is an appetite for “investment grade debt”. Here is another problem. Dow is currently under watch to be downgraded to “below investment grade” from the ratings agencies due to the possibility of the forced merger. Where Dow to attempt to issue new debt right now, to think it would be granted at investment grade is wish-full thinking at best. Dow has been exploring additional financing options and has found nothing that is amenable. Does Paulson think this avenue has not been explored?

He says “depending on term” he would seriously consider participating” in a stock or hybrid offering, well, my response would be “why not be like Berkshire (BRK.A) and take some convertible preferred now?” Buffett bought $3 billion, how much do you want? Promises of consideration after the fact are, well, meaningless.

Let just see this for what it is, a Rohm $ Haas (ROH) shareholder who wants to just cash out. You know what? That is ok, who can blame him? I don’t. But as a Dow shareholder, the best thing for US is to delay the closing, sell the commodity businesses and then use that money to complete the transaction and preserve the dividend. That is what is best for us and the management he is writing to works for us, not him or Rohm & Haas shareholders.

Mr. Pauslon, if you want us to take your ideas the least bit serious, come aboard and pick up some shares, debt, or preferred. Do not sit there and tell us what the best thing for us to do is.

We’re not listening..

Disclosure (“none” means no position):

Visit the ValuePlays Bookstore for Great Investing Books

<

I have named my optimistic and very intelligent new writer “Mr. Davidson”. It is a brilliant pseudonym and maybe someday I will be able to explain it.

Davidson Writes:

If you learn the effect of psychology on markets you will come to know that you cannot predict bottoms or tops. These are unpredictable turns in market psychology and is directly tied to the use of margin in how fast greed can turn to fear. No one has a handle on this although many claim to have modeled some market behavior or other only to have a 10 sigma event prove the model wrong. Long Term Capital is the most well known, but lately the market is strewn with disproved models. AIG hung its hat on a model by a Wharton/Yale professor and “poof”

You cannot model human behavior. You can observe, you can place a historical deviation to it, but you better not hang 20xleverage as so many have done and lost.

There is no better indicator of market psychology than the Treasury yield chart. All maturities are rising. This reflects substantial flow of funds into other opportunities. If fear still ruled, you might see the longer term maturities rates rise while the T-Bill rates remained low or even turn negative once again. Not so. All maturities show fund outflows. THIS IS THE TURN!

Buffett recognizes this among others.

He also provides the following chart:

Of it he says:

We have already witnessed a return to par of the LQD ETF(Invest Grade Corp) and a substantial rise in the HYG ETF(HiYield Corp) as well as rises in all the indices since November. House sales appear to be finding a bottom, The insider buying is extraordinarily high, investor and consumer pessimism at record 30yr+ levels, savvy investors announce new commitments(Buffett, Ackman, Berkowitz, Cumming and many not as well known) weekly.

Changes are there for all to see if only they would give up listening to the endless stream of negative headlines. Markets turn without fan fair in the gloom of pessimism. I think the best time is to invest is now.

Treasury rates are rising across all maturities as this chart from Don Hay’s recent note indicates. The best interpretation in my opinion which has been offered by only few observers thus far is that capital is flowing from Treasuries to other parts of the economy and securities markets. The desperate hoarding of cash that has been a hallmark of the current economic slump is diminishing in my view.

I remain positive that the current financial issues will be resolved and that this chart provides strong evidence for this.

Disclosure (“none” means no position):

Visit the ValuePlays Bookstore for Great Investing Books

Trying to think of a good moniker for my optimistic reader who sends me these excellent posts…idea?

The reader writes:

I saw this and would agree with Jackson that auto sales are the key. If you could get 10-15% increased sales from improved credit then I think the market as a whole would take this as a very strong positive. This would be the signal that the market needs to flip from thoughts of a dire “end to the world” to one of “on the track to recovery”.

The best investors look at what key individuals are doing every day. I get Google alerts to about 200 corp managers and portfolio managers. These are individuals whose track records I have screened and found to be much, much better than the rest. Most look to see what a guru is buying, but have no idea as to what that individual’s investment is really like. So, most remain in constant confusion of looking for sound bites-Buffett buys BNI and don’t know how to determine what Buffett sees. You have to study people and once you see reported activity or comments, you must be able to place Buffett in context with Berkowitz and these “gurus” in context with others as well as market valuations to get the full picture. You must go deep enough to be able to judge the investment judgment of these “gurus”.

The world is about individuals. We tend to lose track that companies are run by individuals and that track records for PG or AN are only in a minor fashion the track records of their very different industries. Track records of companies are mostly the track record of a single individual, the CEO and the culture he/she imposes on the machinery of a business. Once your focus is on the people and a business cycle of ~5yr, then you begin to listen to only individuals like Mike Jackson or Warren Buffett and the like. You tend to ignore the wealth of worthless information thrown about and focus only on the valuable tidbits. It is these tidbits you string together in a cohesive line of investment analysis. I take Bruce Flatt’s activity, add the story of Moulder and Vaughn buying real estate in London and juxtapose with Mike Jackson’s commentary within my over all process and get a picture that we are on the verge of a major change in market psychology for the better. Psychology = trust/lack of trust = Liquidity and Credit. Flip psychology to a positive track and the world suddenly has a different perspective-the market soars.

Here is the WSJ Article he references (for the record I am long AutoNation, I have no idea if the reader is):

Posted on Fri, Jan. 30, 2009

AutoNation (AN) looking to reverse sales slide

BY PATRICK DANNER

Coming off a dismal three months for car sales, Fort Lauderdale’s AutoNation is counting on federal aid to jumpstart the moribund car business.

AutoNation, the nation’s largest seller of cars, hopes a new plan by the Federal Reserve to loosen credit will be the cure for consumers who haven’t been able to buy a car because they can’t get a loan.

”I really see a tipping point in the first quarter, in February, with TALF,” said Mike Jackson, AutoNation’s chairman and chief executive, referring to the Federal Reserve’s Term Asset-Backed Securities Loan Facility.

The U.S. central bank, as early as next week, could start offering up to $200 billion in loans to investors that hold securities backed by pools of auto loans and other debt. The intent of the program is to get banks and other institutions lending. Jackson blamed Lehman Brothers’ September bankruptcy for freezing credit markets.

”We do believe there is a possibility of improvement in March if credit really begins to thaw,” Jackson said. ”We could have a lift in [sales] of 10, 15, 20 percent in a very short period of time if we could get some level of normal credit” for borrowers.

Any improvement can’t come soon enough for the nation’s largest automotive retailer, which just endured what Jackson called the most difficult period in his 40-year career.

”Never in the history of the automobile business has there been a collapse in sales for every brand and every manufacturer in every part of the country,” Jackson said. “Everything surprised me in the fourth quarter.”

AutoNation’s revenue plunged by a third to $2.7 billion, primarily on the drastic drop in sales of new and used vehicles. For the year, AutoNation recorded revenue of $14.1 billion — its smallest in a decade.

AutoNation sold 45,400 vehicles last quarter, about 30,000 fewer than in the same period in 2007. That was nearly a 40 percent drop, but better than the 49 percent slide the industry experienced, noted AutoNation President Mike Maroone. Unit sales of used vehicles were off 21 percent. In Florida, where AutoNation operates dealerships under the Maroone name, sales were off 50 percent, Maroone said.

Still, AutoNation turned a profit for the quarter after sustaining a $1.4 billion loss in the third quarter from writing down the value of some of its dealerships — which ended a string of 34 straight quarters in the black. The company earned $67.1 million, or 38 cents a share, aided by a tax benefit and the repurchase of debt. For the year, it lost $1.2 billion.

Earnings from continuing operations, which exclude special items, was 12 cents a share — narrowly beating the average 11.5-cent estimate of 12 analysts polled by Bloomberg.

Meanwhile, AutoNation announced it achieved $200 million in annualized cost savings, double the reductions forecast in July. The company trimmed its workforce by about 3,700 people last year, significantly reduced advertising spending and cut the number of stores.

As much as 80 percent of the cost reductions are considered permanent rather than temporary, said Michael Short, AutoNation’s chief financial officer, during a conference call with analysts.

At the end of the year, AutoNation had an 84-day supply of new vehicles, up from 52 days at the end of 2007. By comparison, Maroone said, the industry had a 119-day supply at the end of 2008.

To shrink inventory, and in turn lower the interest it pays carmakers while those vehicles sit on its stores’ lots, AutoNation earlier this month said it was cutting orders of new vehicles by as much as 60 percent.

On Thursday, Jackson acknowledged AutoNation has encountered some resistance from manufacturers. General Motors and Chrysler, in particular, have implemented programs requiring dealers to buy more inventory to receive incentives on the inventory they want, he said. ”That has definitely created some friction,” Jackson said. ”But we’re not playing that game.” AutoNation is getting the vehicles it wants, he added.

GM spokeswoman Susan Garontakos said she had no comment on Jackson’s remarks. ”No one forces a dealer to do anything,” she said. “A dealer can decide to do that or not.”

Said Chrysler spokeswoman Carrie McElwee: “We’re not pushing back. We’re really talking to [dealers] about the programs and initiatives we have for 2009.”

Disclosure (“none” means no position):Long AN

Visit the ValuePlays Bookstore for Great Investing Books

Berkshire Hathaway (BRK.A) has purchased $300m of Harley Davidson’s (HOG) debt. The real news is he is getting 15%, so much for credit “loosening up”.

Disclosure (“none” means no position):Long HOG

Visit the ValuePlays Bookstore for Great Investing Books

Berkshire (BRK.A) keeps adding Burlington Northern shares (BNI).

This is from a December transaction in which Buffett was paid $6.35 per share. So, even though Buffett was “put” (sold) the shares at $75, when the premium he received is subtracted, his cost basis is $68.75 or $1 below the current price.

Disclosure (“none” means no position):None

Visit the ValuePlays Bookstore for Great Investing Books