I had several folks wonder what this was when it was first discussed here

“Davidson” submits:

One of the most difficult tasks one can have is to find a proper method of valuing the marketplace as so many competing methods are offered. I have looked to basics and once I learned of Knut Wicksell, much became clear.

My view which has developed over the years is that capital returns follow the Wicksell Rate which was first authored in 1898 by Knut Wicksell. This rate is the US Real GDP Trend + the trimmed core PCE (core inflation rate as run by the Dallas Fed). Written as the formula:

Real US GDP(long term trend) + 12mo trimmed mean PCE(Personal Consumption Expenditure per Dallas Fed) = Wicksell Rate

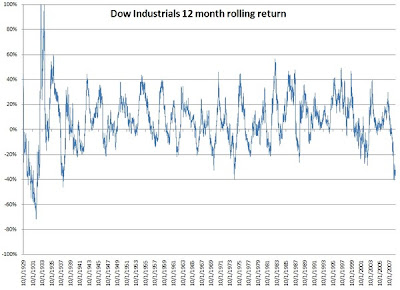

All long term returns arbitrage about this rate but with considerable deviation due to market psychology (Chart Below) and earnings swings. Long term this should be about 5% if inflation is kept between 1.5%-2% and equates to a 20 P/E on the SP500. The emergence of inflation can substantially depress P/E’s regardless of the strength or breadth of earnings and represents the greatest risk to undiversified portfolios. The Dallas Fed has information on Wicksell. .gif)

Coming to terms with periods of economic distress and the associated market declines can in my view be greatly fortified by looking at some of our economic and market history.

US Real GDP (Chart Below) shows just how resilient the US economic system has been over nearly 80yrs. There have been seemingly catastrophic events, i.e. Herbert Hoover followed by FDR, WWII, Kennedy’s assassination, rampant inflation, Richard Nixon followed by Jimmy Carter, “Death of Equities”-1982, Crash of 1987, Crash of Long Term Capital, Crash of the Russian and Asian currencies, Crash of the Internet Bubble and more yet we have ALWAYS snapped back. Note that in the early 30’s with 4 weak years we had 4 quite strong years so that the avg. US Real GDP trend has been in fact a fairly smooth procession from a smallish economy of ~3.9% to the one we have now of ~3.2%. I think you can rely on the fact that our society’s productivity has had resiliency that is basic to our system of government. I do not think that we have destroyed US productivity in our current situation. In fact the evidence suggests that productivity has improved. I for one trust that we will return to the normal trend in a couple of years including a few years better than 3.2% to reestablish the long term trend..gif)

Turning to the SP500 chart(Below) note the earnings trend of ~6.1%. I observe that Greenspan’s tenure has resulted in higher than normal earnings volatility vs. Paul Volcker. Although I did not draw it on this chart, my previous trend had been slightly below 6% before I recently added on the last 5yrs of earnings. It would appear that as technology has entered our economy’s various nooks and crannies we have been more productive and our earnings from our existing capital has risen some what..gif)

I view the earnings in 1974, 1982, 1987, 1990 and 2002 as low points. We are close to comparable low earnings levels today. The market psychology today is comparable with similar media headlines of crisis and fear of Depression. However, we have avoided Depressions since the 1940’s due to the Federal Reserve acting as a financial shock absorber thus giving our society and economy financial breathing space to adjust to new conditions. This is why the US Real GDP has had decidedly much less volatility over the years as the Fed has exercised its financial cushioning actions. I estimate the current Standard Deviation at +/- 2.4%. This is well below what we had experienced in the ‘30’s of +/- 14%.

Yes, we may see lower earnings than we have seen, but historically most of the damage is done in my opinion. The Fed has loosened the purse strings forcibly and in multiple modes. So that, even though the media argues in the same fashion as in the past that the Fed either has not done enough or not done it the “Right” way, the end result is that the Fed has acted forcibly and our economy remains free to sort out the process of recovery. I have sent you several studies that indicate the early stages of recovery are with us.

The advice I provide is also based on that proffered by some of the greatest investment minds of the last 50yrs, i.e. Warren Buffett, Bruce Berkowitz and many more too numerous to list. A continuous process is in use in my office to assess the current insight of the most astute investors which I believe to be extraordinarily helpful

The advice to add REITs( see 5th Chart), Nat. Res and EmgMkts as part of a balanced portfolio is based upon the longer term observations of US economic strength and history as well as other observations as noted above. The use of the Wicksell Rate and the 5yr MovAvg Return/Risk analysis( 4th Chart) is helpful to determine when asset classes evolve to carrying higher levels of risk than is appropriate. Today this means to avoid Treasuries. Berkshire’s (BRK.A) Warren Buffett just called Treasuries a “Bubble” in his latest Chairman’s Letter. A comparison of Treasuries with the current 5.4% Wicksell Rate confirms this view.

The reason for being in most available asset classes(but for Treasuries) today is simple. They all appear relatively cheap. To try to focus on one or another using an expected return is difficult. You can be right on the earnings trend, but if the market cares more about another area you will not be rewarded with expected gains. Psychology plays a huge role in all markets as most market players are trend followers. In my opinion they are “Players” not “Investors”.

Disclosure (“none” means no position):none

Visit the ValuePlays Bookstore for Great Investing Books

.gif)

.gif)

.gif)