This is one of the most reliable market predictors……..if it holds, we aren’t even close to the end of the rising market…

Tag: spy

S&P 500 Intrinsic Value Index Update

The US Oil Situation

The price of oil is finally rising….it can go significantly higher

We’ve addressed our feelings on the uselessness of CAPE before but I am seeing it being used frequently once again so it is time to revisit….

In fact, the WSJ just referred to it again…..CAPE hasn’t “worked” in over a decade at predicting anything (not that it ever really did)…it.s time to put it to bed

Economies Drive Markets

Some of Davidson’s best work….

We’ve been saying this here for the last 4 years as markets have continued to climb higher….

The 10yr/T-bill spread is telling a different story than the media….

The Dollar & Oil

“Davidson” submits:

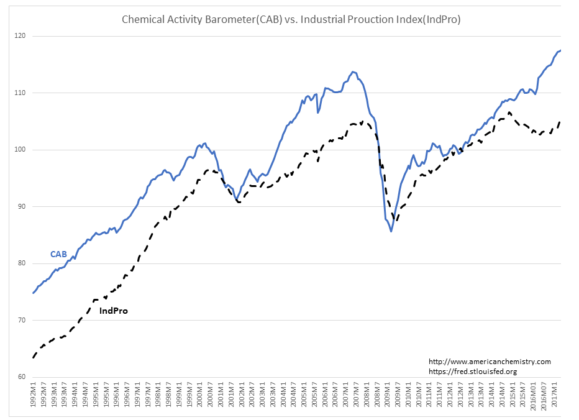

“Dr Copper” as an economic measure is becoming popular again, but where has it been the past 8yrs when the US economy has been in an uptrend since 2009 as shown by IndProd.

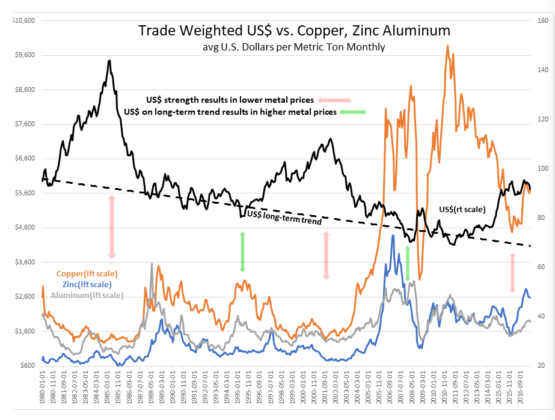

Commodity prices are priced in US$ globally and cycle pricing is more about the Trade Weighted US$ and global capital flows than anything else! Global capital flows are shifting back to Intl markets as the US$ foreign policy swings back towards support for Democratic institutions after a period of support withdrawal. The US$ is beginning to return to its long-term trend and commodity prices are rising as a result. Oil prices which normally rise during periods of political stress fell with North Korea’s threats as there was a brief period of capital flows back into the US seeking safety with the ‘saber rattling’. Now that fear of military action appears to be behind us, the US$ appears to be resuming its return to the long-term trend.

The fear inspired by the Russia’s Ukraine invasion, the rise of ISIS and global terrorism resulted in a sharp rise in US$ in 2014-2016. US foreign policy has begun to reassert global Democratic protections. As investors perceive this to be effective, we can expect the Trade Weighted US$ Major Currency Index to fall another 25% from current levels as global capital flows normalize.