Yeah……>80% correlation with GDP…

Tag: theory

$$ NAREIT Index Update

Still more good news ….

“Davidson” submits:

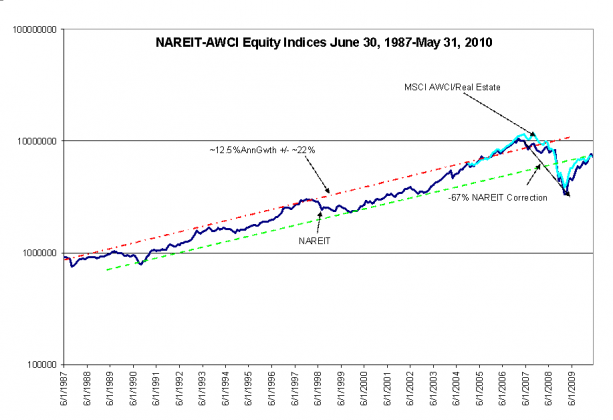

The NAREIT Index is updated thru May 2010 below (the MSCI AWCI data was N/A at this time). The history of the NAREIT reveals long term trends that have been impacted by multiple themes. Tax law changes in the Tax Reform act of 1986 substantially reduced returns to investors in this asset class. The Community Reinvestment Act 1996 accelerated capital inflows into sub-prime lending that in effect created a classic “Too much Capital Reduces Returns” event which resulted in excessive real estate pricing and a peak in this index Feb 2007 which was followed by a sharp ~67% 2yr correction. The NAREIT Index bottomed in March 2009. The global MSCI AWCI Index behaved similarly which reflects the global nature of the commerce and financial markets. The total returns of the NAREIT Index since the Tax Reform Act 1986 appear to have been relatively consistent within an annual trend of 12%-13%. Any significant alteration of the tax environment could and would affect future returns. Currently 12%-13% returns going forward seem viable as the real estate market recovers from the excesses of the past few years.

Real estate is integral to commerce and the financial markets with mortgages in the US on par with SP500 market capitalization. Standard and Poor’s reports the SP500 Mkt Cap currently stands at ~$9.5Trill while US mortgage debt outstanding as of Dec 2009 is $14.64Trill per the Federal Reserve . The NAREIT Index as of Dec 2009 had a market capitalization of ~$250Bill . In portfolios, allocations are determined as a result of studies based on Monte Carlo simulations using historical performances of the important asset classes.

In my experience investors often over commit capital to a particular asset class seeking excess returns. They just as often meet the unexpected event of a sharp correction. These corrections have been labeled “Black Swan” events as if they occur without rational causation. The indices provide useful historical contexts for observing market excesses as the NAREIT and MSCI AWCI/Real Estate charts demonstrate.

Currently REITs appear favorably positioned.

More good news…

Last nights show…

“Davidson” submits…

“Davidson” submits…

$$ More on Retail Sales

Time frame…..

$$ Market Dynamics….Some Thoughts

“Davidson” submits….